Mortgage Rate Update January 19, 2017

Well, after a nice 5-week run mortgage rates ticked higher yesterday giving away half the improvements they gained on the way down.

The culprit? Fed Chairwoman Janet Yellen delivered a speech yesterday in which she stated that Fed officials expect to raise short-term interest rates “a few times a year” through 2019. This was more aggressive than her previous public comments and leads the markets to believe that inflation expectations may be higher than anticipated.

Speaking of inflation expectations, the Wall Street Journal ran THIS STORY yesterday which confirms just that. The spread between US treasuries and inflation protected treasuries has been widening signaling that investors believe inflation will be higher in the future than it presently is. Inflation is the primary driver of mortgage rates.

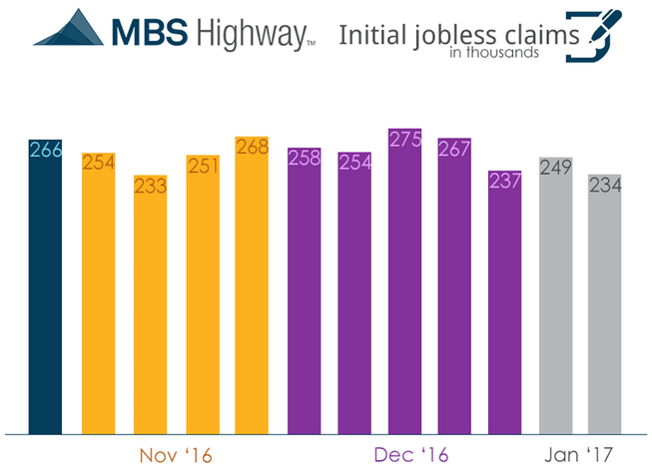

The jobs picture continues to be strong both nationally and locally. This is bad news for mortgage rates but good news for housing demand. The number of Americans filing for initial jobless claims fell last week to one of the lowest levels on record.

Furthermore, it was reported that Oregon’s unemployment rate fell to 4.6% which is down nearly 1% from last summer.

All in all the momentum has shifted against us. Fortunately we remain within a technical range of trading so we could see rates improve off these levels. For now though I will shift to a locking bias.

Current Outlook: locking bias