Mortgage rates trend lower, how long will this last?

If you feel the urge today is National Dance Like a Chicken Day. Not sure where they come up with these but if the Blazers can win tonight in game one of the Western Conference Finals I will be dancing like a mother clucker!

Mortgage Rates

Mortgage rates continue to benefit from the trade dispute that is ongoing between the US and China.

Last week US stock indexes lost 2%-3% as investors braced for the economic fallout. When stocks do poorly it tends to help mortgage rates improve.

Stocks are rebounding today which is placing upward pressure on home loan rates.

Loan Performance

CoreLogic released its monthly Loan Performance Insights report for February. It showed that the number of mortgages in delinquency fell in every category relative to last year and are at 20-year lows.

This may influence lenders to accept more risk in their loan portfolios which means it may become easier for borrowers to borrow money and buy houses.

Technical Guidance

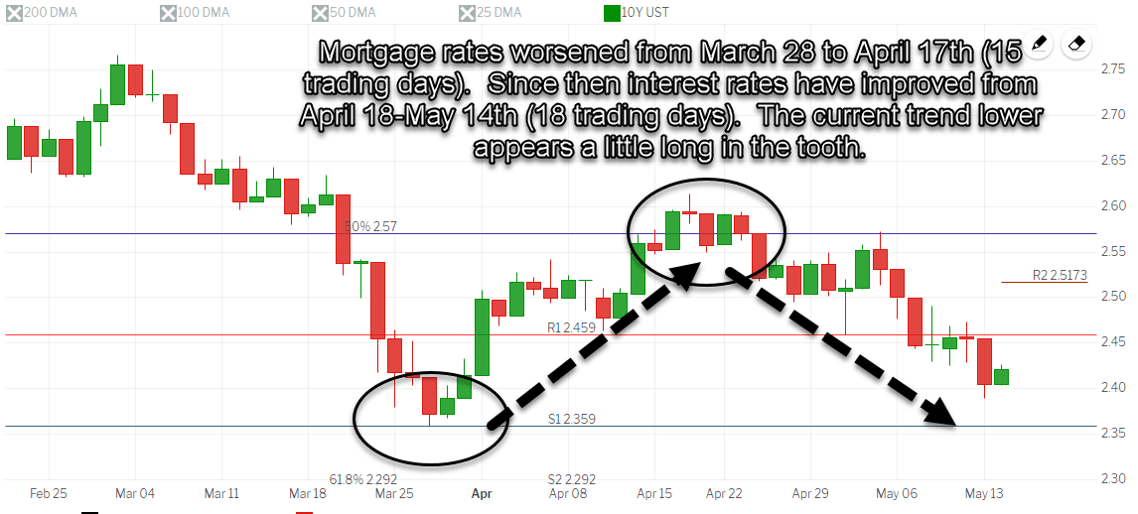

Financial markets tend to work in cycles and home loan rates are no different.

From late March to mid-April interest rates worsened. Since then home loan rates have been on a winning streak for roughly the same duration. I am concerned we may see rates reverse and cycle higher.

The Week Ahead

Looking ahead this week we’ll get retail sales on Wednesday, housing starts/ permits on Thursday, and consumer sentiment on Friday. There are also a series of Fed speakers on the docket.

Current Outlook: locking bias