Home price gains moderate while mortgage rates improve

Every Tuesday I try to explain what is happening in the financial markets that will impact mortgage rates. The truth is sometimes I highlight factors that do influence interest rates and sometimes I don’t. Sometimes mortgage rates fluctuate……just because.

Today is National Just Because Day so if there is something you’ve been wanting to do but never done it. Well…. today is your day.

Mortgage Rates

Two weeks ago I highlighted the divide between fixed mortgage rates and the yield on the US 10-year treasury. At that time the 10-year treasury yield had fallen by .40% while mortgage rates had only improved by .25%.

As I had expected and hoped, that spread tightened this week as mortgage rates have improved by ~.25% and the 10-year treasury yield has only improved by ~.125%.

Home Prices

The S&P Case Shiller Home Price Index report was released earlier today and showed that home price appreciation slowed in June to +3.1% nationwide (down from +3.4% the prior month). In Portland home price gains remained at +2.4% year-over-year which is unchanged from the previous month.

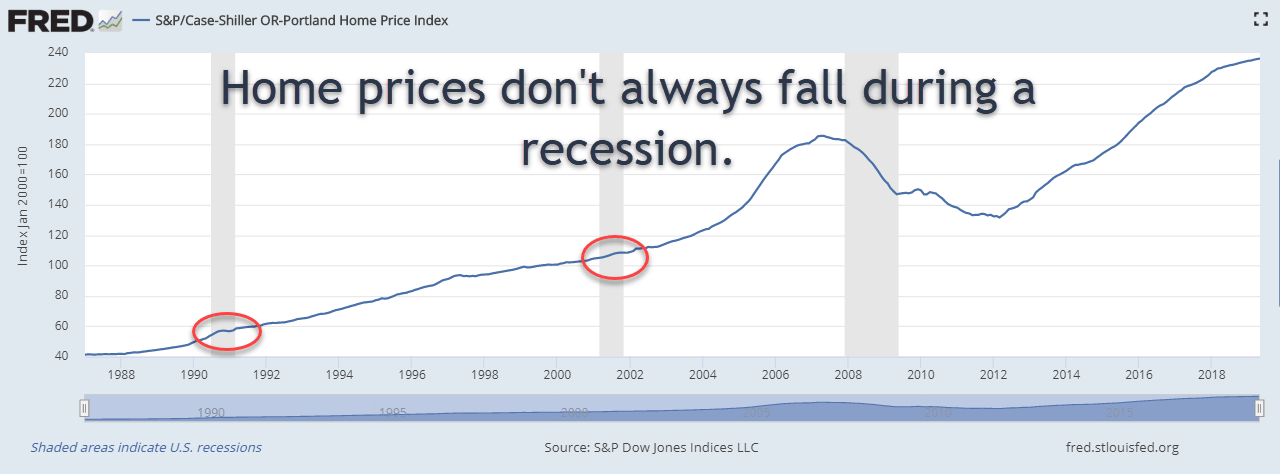

Home Prices during recessions

As the US yield curve continues to invert the media is growing more focused on the possibility of a recession in 2020. Some prospective home buyers are assuming that if a recession does take place that home prices will fall.

However, it’s important to note that prior to the most recent economic recession, which was primarily caused by speculation in housing, home prices in the Portland-metro region actually increased during economic slowdowns.

Therefore, if a consumer is planning to wait for home prices to drop they may be disappointed.

Outlook

The remainder of the economic calendar this week is light and we expect trading volumes to be low as we head into Labor Day weekend. Momentum remains on our side so I will maintain a floating bias.

Current Outlook: floating bias