Home Loan Rates Stable, Home Prices increase at a decreasing rate

On this day in 1789 a crowd of 10,000 gathered outside the Federal Hall in New York City to witness George Washington being sworn is as the first president of the United States.

Washington’s salary as President was $25,000/ year which translates to $722,165 in 2019 dollars. In comparison, President Trump’s annual salary is $400,000. There is no data on how much income tax each President paid…..

Mortgage Rates

After increasing modestly last week home loan rates have stabilized and even improved very modestly this week.

The Federal Reserve

The Fed kicks off a regularly scheduled 2-day meeting today which will conclude tomorrow. It is not expected that the Fed will make any changes to interest rates.

At this point US economic growth remains solid and inflation pressure is relatively muted. However, the Fed’s post-meeting comments can move the markets so we’ll be listening.

Housing Market

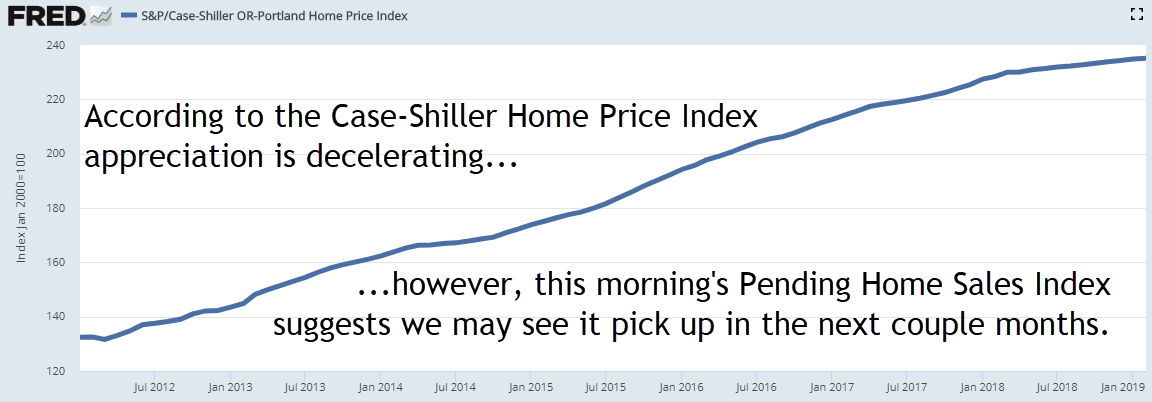

The Case-Shiller Home Price Index was released earlier today. The report showed that nationwide home price appreciation decelerated from February 2018 to February 2019.

For Portland, the report showed home prices increased by 2.9% from February 2018 to February 2019. Home prices are still increasing. However, they are increasing at a slower rate.

The National Association of Realtors released its monthly Pending Home Sales Index report earlier today. Although the number of homes under contract is down from a year ago it did jump by 8.7% in the west during the month of March compared to February.

Stronger demand may show up next month when we get updated appreciation information.

The Week Ahead

The remainder of the week is busy in terms of economic news. We’ll get the latest all-important jobs report this Friday. Analysts are expecting +210,000 new jobs created for April.

We’ll also get the aforementioned Fed statement on Wednesday and other Fed speakers on Friday.

Current Outlook: floating bias