Mortgage rates worsen slightly following a strong jobs report

Home Loan Rates

Mortgage rates have worsened modestly from last week’s ‘rate update’.

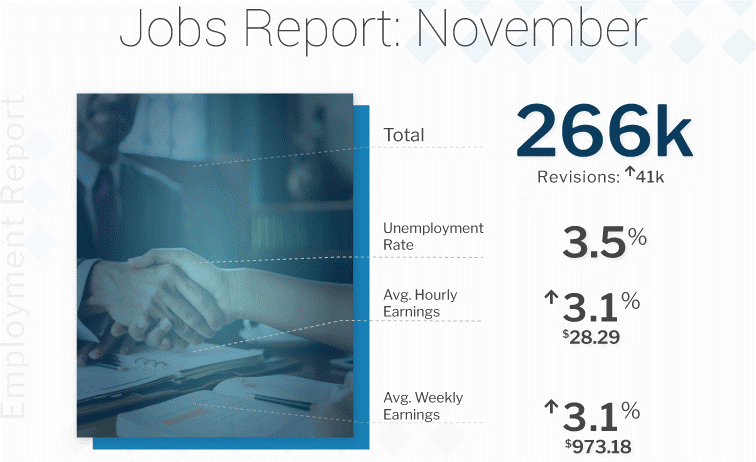

Jobs Report

Last Friday’s all-important jobs report showed that the US economy added 266,000 new jobs in November. The national unemployment rate ticked down to 3.50%. The results were stronger than analysts had anticipated, which is bad news for interest rates.

Here in Oregon job growth has slowed but fortunately layoffs remain low. The main reasons for the slowdown in job growth is lower migration into the state and the aging of our population.

Trade Outlook

As I have written repeatedly over the past few weeks trade seems to be the main driver of interest rates as of late. When it looks more likely that trade agreements will be reached it causes stocks to rise and pressures interest rates higher.

Earlier today it was announced that Democrats had reached a deal with the Trump administration to approve a new trade agreement with the US and Canada. Should this get pushed through Congress it may cause mortgage rates to worsen.

There have not been any significant developments between the US & China.

The Technical Outlook

The US 10-year treasury note is currently yielding 1.83% which is slightly above multiple layers of support. Furthermore, mortgage backed-bonds have drifted below several layers of resistance. Combined, the technical outlook is not favorable for mortgage rates at the current moment. There is more room for rates to move higher than there is for them to go lower.

The week ahead

This week’s economic calendar is busy. Tomorrow the Fed will conclude a normally scheduled monetary policy meeting. No changes to short-term rates are expected but the comments following their meeting can influence interest rates.

We’ll also get the latest reading on inflation (Consumer Price Index & Producer Price Index) and Retails Sales numbers. Given the aforementioned technical outlook I recommend locking.

Current Outlook: Locking