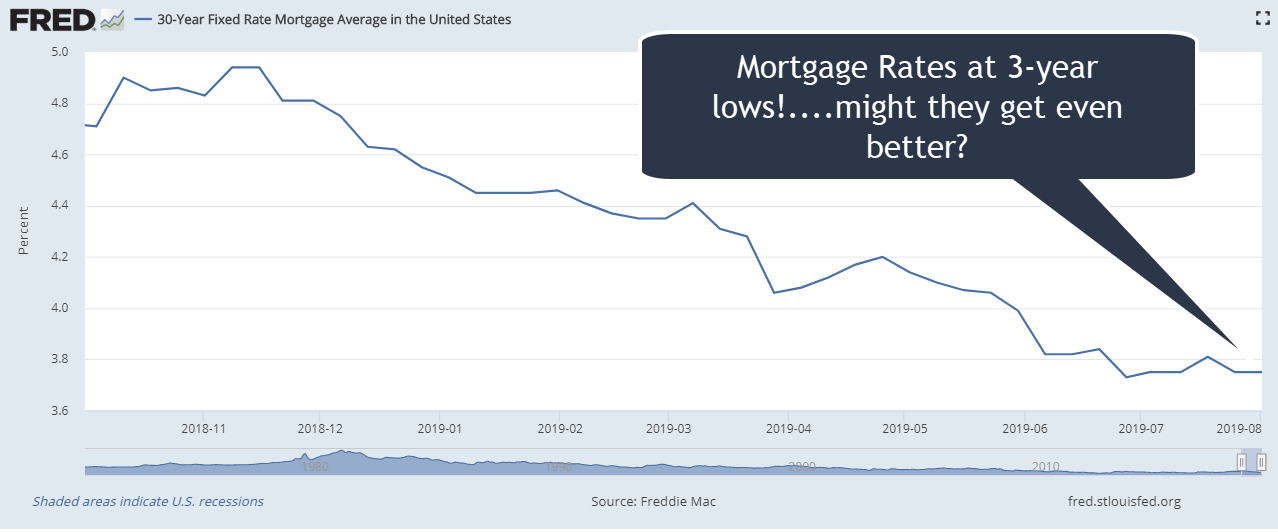

Mortgage rates continue to trend lower

“It would be glamorous to be reincarnated as a great big ring on Liz Taylor’s finger.”- Andy Warhol

Happy birthday to Andy who would have been 91 today.

Interest Rates

We’ve held a “floating” position for some now and it’s paid off. Mortgage rates are at their best levels in over three years and some analysts are calling for them to continue to trend lower.

10-Year Treasury Note

The yield on the US 10-year treasury note, which mortgage rates tend to track, has fallen from 2.05% to 1.75% in the past 5 days. Over that time mortgage rates have improved by .125%. I won’t be surprised if mortgage rates improve by another .125% over the next couple weeks.

Yield Curve

With yields falling for longer duration bonds we are back in a scenario where the yield curve is inverted. Many economists think an inverted yield curve is a signal of an impending economic recession but there are never any guarantees.

China Trade Tensions

Concern over trade tensions pushed US stocks sharply lower on Monday. At the moment it appears that the US and China are a long ways from solving their trade disputes. This is not favorable for near-term economic growth but favorable for US interest rates.

Outlook

From a technical perspective mortgage rates are benefiting from momentum. We could see rates go up later this week but I still believe we are in store for lower rates in the coming months.

Current Outlook: floating bias