Mortgage Rate Update November 6, 2014

Mortgage note rates are unchanged but the accompanying closing costs have worsened slightly this week.

Mortgage rates have remained near the best levels of the year since mid-October but tomorrow’s all-important jobs report could change all that. The markets are expecting tomorrow’s release will show that ~250,000 new jobs were created last month. With the exception of August the US economy has added at least 229,000 new jobs dating back to May. Should the report beat expectations we’d expect rates to rise and vice versa.

Earlier today the Bureau of Labor Statistics reported that worker productivity grew by 2% during the 3rd quarter. This is welcome news for interest rates because the more productive workers are wage-based inflation should remain moderate.

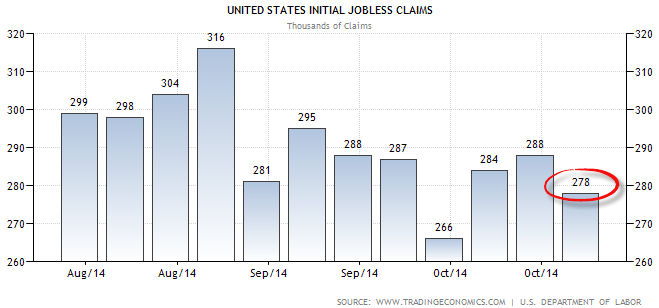

Remaining on topic, weekly jobless claims for last week were reported lower than what analysts had expected. Good news for the economy tends to be bad news for mortgage rates.

From a technical perspective, yields have risen on the US 10-year treasury note 11 out of the past 16 trading days (dating back to October 16th). During that time mortgage rates have increased by ~.125%-.25%. I am cautious about floating because of the long-term reality that rates will eventually rise and therefore will recommend a locking bias.

Current Outlook: locking