Mortgage Rate Update May 21, 2015

Mortgage rates are mostly unchanged from Monday’s ‘rate update’. Although my last couple updates have reported unchanged levels of interest rates there has been volatility in between my posts.

Minutes from the most recent Federal Reserve monetary policy meeting were released yesterday and showed that the Fed will continue to be patient in raising short-term interest rates. According to the release most Fed officials do not see the economy strengthening enough to be able to raise rates at their next scheduled meeting June 16-17th. For the time being this is good news for mortgage rates.

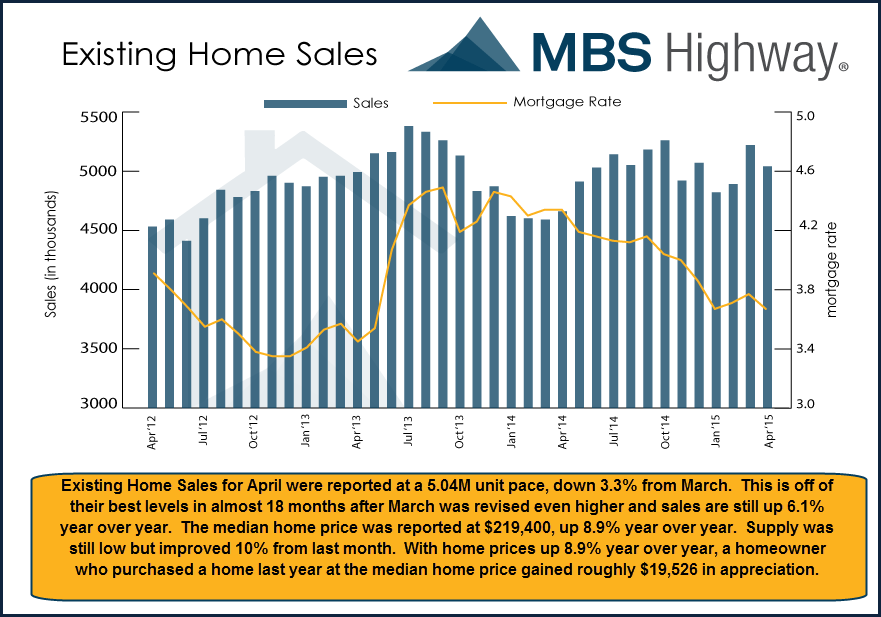

Earlier today the National Association of Realtors released the latest reading on existing home sales. In terms of volume of sales the number of transactions fell in April by ~1% from a year earlier. At first glance one might think this would signal weakness in the housing market. However, given that the median home price continued to pace higher (+8.9% year-over-year) we know that the drop in sales is not a result of weak demand but instead low supply.

From a technical perspective mortgage rates are trying their best to eek their way back down but they have not convincingly broken through important technical resistance. For now we can float but should rates reverse higher, which I anticipate, we’ll need to lock in.

Current Outlook: carefully floating