Mortgage Rate Update May 15, 2014

I’ve recommended a “floating” outlook since May 5th and fortunately this advice has proved correct. 30-year fixed rates fell another .125% this week and are now at the lowest levels of 2014.

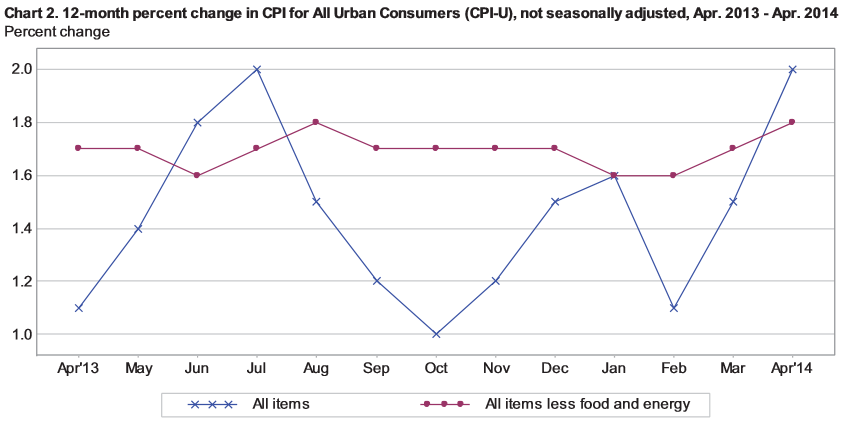

We received a fresh batch of economic data today and most of it was unfriendly. The Labor Department released the Consumer Price Index (CPI) and it showed that year-over-year prices increased by 2.00%. This was hotter than expected and the biggest year-over-year increase since July of 2013. Inflation is bad for interest rates because it erodes the purchasing power of the lenders repayment.

In addition, weekly jobless claims released today showed the number of people filing for new unemployment benefits fell to the lowest level in 7 years. Lastly, a survey from the New York Federal Reserve Bank showed that manufacturing activity in the Empire region was much stronger than expected last month. Good news for the economy is typically bad news for mortgage rates.

Momentum has helped mortgage rates improve in May. In 14 of the past 18 trading days mortgage rates and/ or the accompanying closing costs have improved. In large part, this has been in reaction to the geopolitical uncertainty in Ukraine AND comments from central bankers. Investors continue to believe that the Federal Reserve (US), Bank of England (UK), and European Central Bank (EU) will continue with monetary stimulus designed to keep interest rates low. As long as that expectation holds rates should remain relatively low.

From a technical perspective I believe this rally is running out of steam so will shift to a locking outlook.

Current Outlook: locking