Mortgage Rate Update March 24, 2014

Mortgage rates are unchanged from last Thursday’s ‘rate update’.

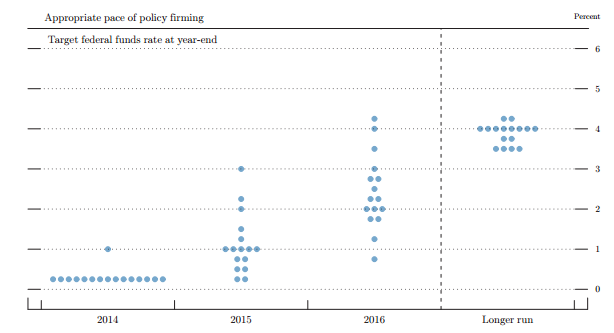

As you may recall mortgage rates rose sharply (.125%-.25%) last week following comments made by Fed Chairwoman Janet Yellen in which she announced that the Fed would move to raise short-term interest rates sooner than the markets had been expecting. Over the weekend other Fed officials tried their best to soften the impact of Yellen’s comments. Goldman Sachs reiterated the position it held that prior to the comments that the Fed would hold off on boosting short-term rates until 2016.

The debate is exactly what Janet Yellen would like to avoid. Markets like certainty as opposed to uncertainty even when the event is unwelcome.

Speaking of uncertainty, how strong is the current economic recovery? The US economy has not produced over 200,000 new jobs in a month since November 2013 and much of the other data is mixed. This week we’ll get the latest read on the housing market (Case-Shiller + New Home Sales + Building Permits + pending home sales), durable goods, gross domestic product, and wholesale inflation. Most of the new data is scheduled for release in the latter half of the week.

From a technical perspective the market looks fairly good for mortgage-backed bonds. Since there is no clear trend with regard to the recent economic data I will recommend floating to start the week.

Current Outlook: floating