Mortgage Rate Update June 8, 2015

Mortgage rates had a tough run last week. They have increased by ~.25% in the past week and a half. Yields on US government bonds suffered the worst sell-off in over two years during the same timeline.

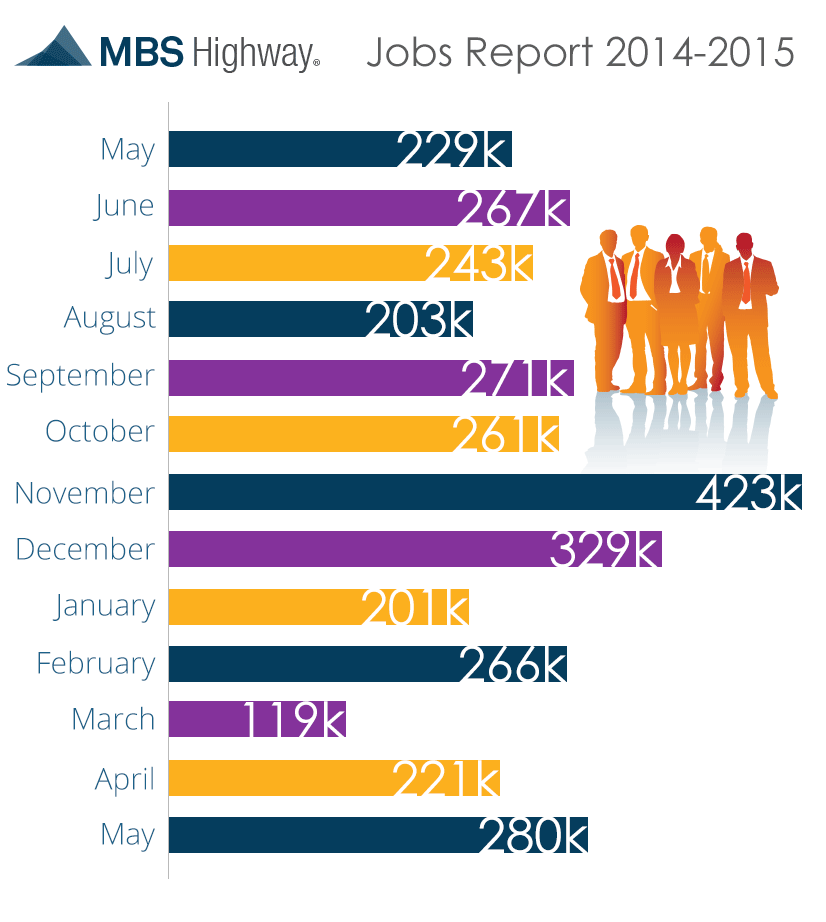

In case you missed it Friday’s all-important jobs report showed that the US economy created 280,000 new jobs during the month of May. This was better than expectations and the highest reading since December of last year. With the exception of March the US economy has added at least 200,000 new jobs each month for the past year.

Also embedded in the jobs report is information about average hourly earnings. This part of the report showed that wages increased by more than expected last month which is an unwelcome sign for inflation and therefore interest rates. With another healthy month of job growth analysts think it is more likely that the Fed will begin to raise rates later this year (versus early next year).

The economic calendar for the week gets busy in the latter half. We’ll get retail sales on Thursday along with initial jobless claims. On Friday we’ll get the latest reading on the producer price index. Inflation is the missing piece of the puzzle for the Fed to begin raising rates. It will be interesting to see if the PPI shows any signs of accelerating.

From a technical perspective mortgage-backed bonds are trying to rebound after a very tough ride. We’ll float for now to see if we can recoup some ground.

Current Outlook: floating