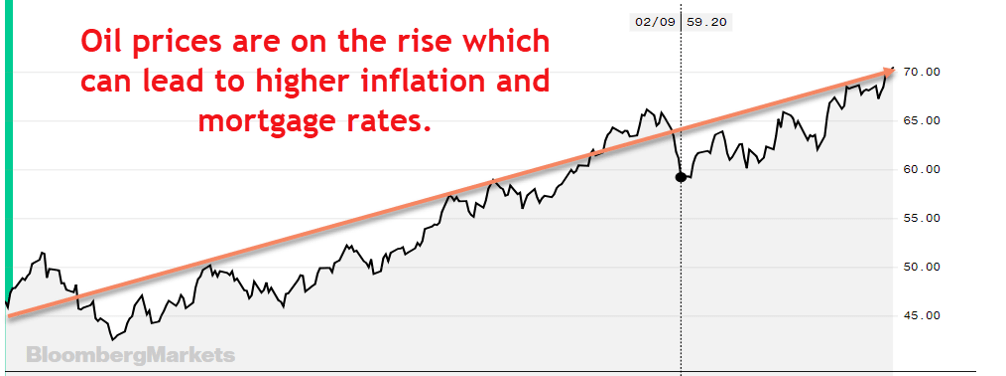

Higher oil prices threaten mortgage rates

President Woodrow Wilson proclaimed the first Mother’s Day holiday this week in 1914. For the past 104 years we have celebrated those special women in our society who desperately need a break yet do not want to miss a single minute. Thank you moms!

Mortgage Rates

Interest rates improved modestly last week but not enough to get excited about. For most applicants their note rate is unchanged but the accompanying closing costs are lower.

Oil prices

Oil prices have been on the rise which does not bode well for mortgage rates. In the past month they have increased by 10% reaching the highest levels since 2014.

When oil prices rise it tends to cause inflationary pressure in the economy. Inflation is the primary driver of long-term interest rates.

The Week Ahead

Speaking of inflation we’ll get the latest reading on the Producer Price Index this Wednesday and the Consumer Price Index on Thursday. If those reports come in hotter than expected I would expect rates to worsen.

Also on Wednesday the US Treasury is scheduled to auction $25 billion of 10-year treasury notes. The added supply could make it hard for mortgage rates to improve for the second week in a row.

From a technical perspective the yield on the US 10-year treasury note is currently at ~2.95%. Fortunately the 3.00% level has acted as resistance so if we test that level again I am hopeful it will hold.

Outlook

I am less optimistic than I was last week but still feel like rates will not move meaningfully higher in the near-term. I will shift to a neutral position.

Current Outlook: neutral