Mortgage Rate Update January 11, 2015

Mortgage rates are improved from the beginning of last week.

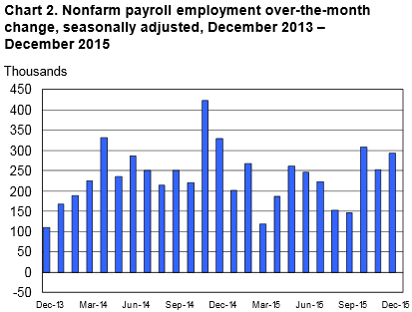

In case you missed it the headline numbers that accompanied the all-important jobs report were better than expected. According to the report the US economy added 292,000 new jobs during the month of December, far more than the ~200,000 that was anticipated.

Normally, we’d expect mortgage rates to suffer in reaction to a stronger than expected jobs report. However, when you dive into the report you realize that many of the gains were made by teenagers and many appear to be seasonal. Therefore, mortgage rates did not react as we’d expect.

Looking ahead for this week the economic calendar is fairly quiet until Friday. At the end of the week we’ll get readings on retails sales, manufacturing activity, and inflation (Producer Price Index).

In the meantime, I expect interest rates to react to global stock markets and technical trading patterns. Globally, stock markets remain vulnerable as concerns regarding the outlook for the Chinese economy reverberate around the world. When market sentiment is negative about the Chinese outlook is helps US interest rates because investor seek “safety” here. The opposite is also true.

From a technical perspective the near-term outlook looks favorable. I am going to recommend floating for now but that may change before I post Thursday’s ‘rate update’.

Current Outlook: cautiously floating