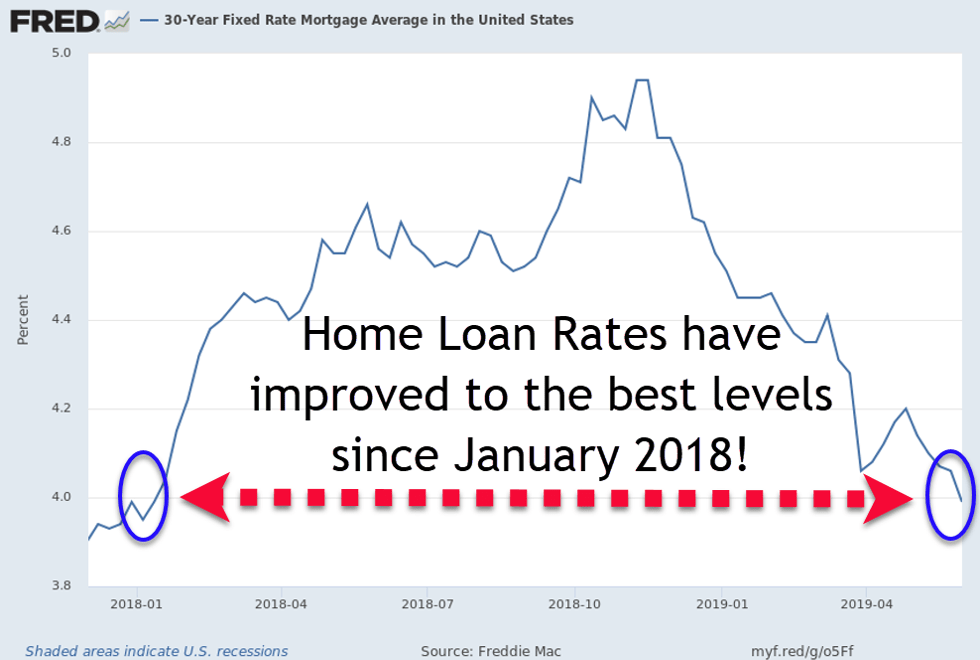

Mortgage Rates hit 18 month lows! Is a Fed rate cut next?

Today is National Cheese Day which is causing me to face my cheddar cheese addiction. Luckily it’s only mild….

Cheese connoisseur’s in China will have to pay a little extra for US cheese thanks to recently imposed tariffs. Will Mexico be next? Trade tensions are the primary reason why mortgage rates are at the best levels since January of 2018.

Mortgage Rates

Home loan rates have improved substantially over the past couple weeks thanks to weakness in the stock market. Investors have been selling stocks in favor of “safer” assets as trade tensions rise between the US and China and now Mexico.

President Trump has stated that if Mexico does not take measures to reduce the flow of migrants crossing the US border then he will impose trade tariffs which will gradually increase starting on June 10th.

The Fed

Investors are not the only people tracking trade tensions. Fed Chairman Jerome Powell announced earlier today that Fed policymakers are monitoring trade tensions closely and might be willing to cut short-term interest rates later this year if the economy demonstrates weakness.

Home Prices

CoreLogic’s Home Price Index report showed that homes across the country increased by 3.6% over the past year. They forecast that home prices will increase by 4.7% over the next 12 months.

The Week Ahead

This week’s economic calendar is headlined by Friday’s all-important jobs report. Analysts are expecting +185,000 new jobs created in May. A number north of that figure could pressure mortgage rates higher and vice versa.

Current Outlook: locking bias