Mortgage rates are still very attractive.

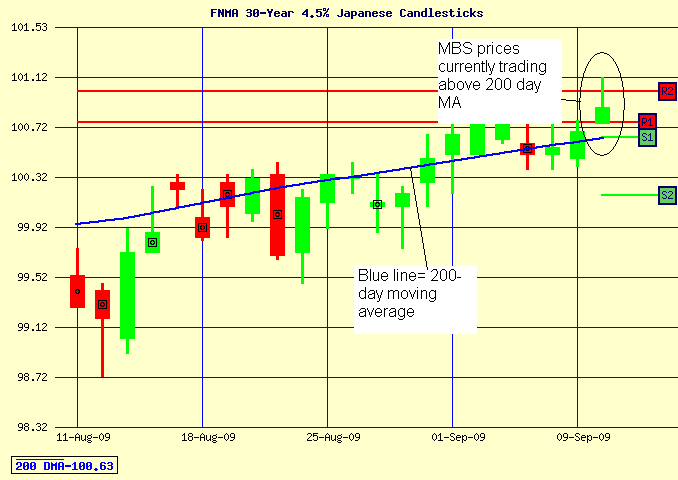

Mortgage-backed bonds (MBS) closed above the all important 200-day moving average yesterday. I explained in yesterday’s update how the US Treasury auction may dictate the direction of MBS prices and that seems to be the case. Yesterday’s auction was met with strong demand which is helping to keep yields low.

Today the US Treasury will auction of a round of 30-year bonds which will also test the market. If demand remains strong we could see rates move modestly lower.

So long as MBS prices can remain above the 200-day moving average we will remain in a floating position. However, we need to be aware of a “leash-effect” where MBS prices reverse direction sharply.

Current outlook: floating so long as MBS prices remain above 200-day MA