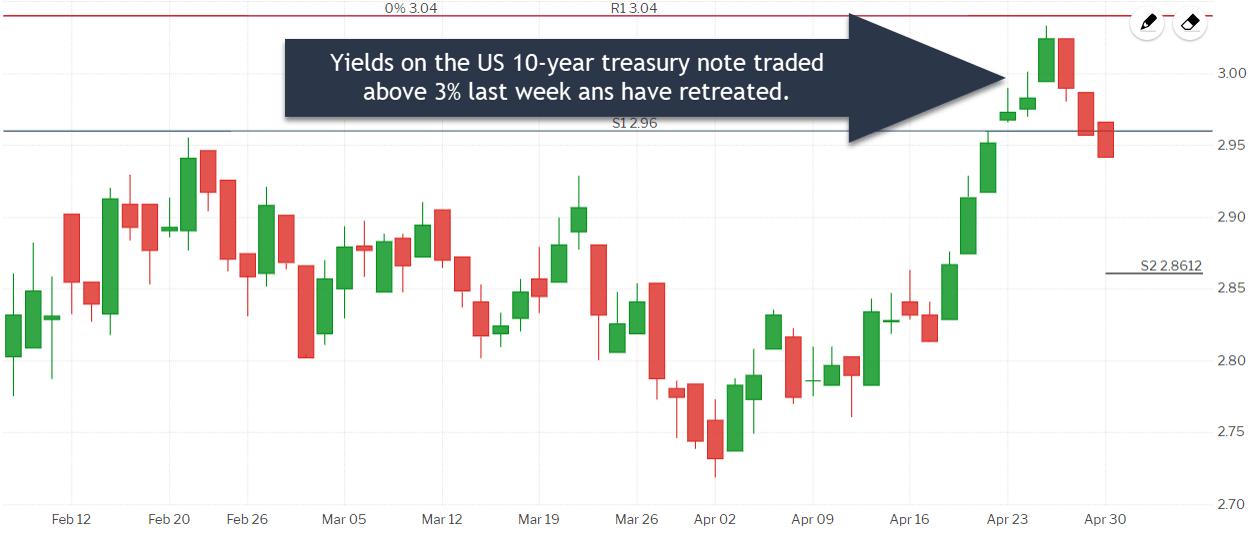

US 10-year below 3.00%, might rates improve this week?

Monday mornings don’t seem like the ideal day for a bloody mary but I would be lying if I said the thought hadn’t crossed my mind. Speaking of “Bloody Mary Mornings” today is Willie Nelson’s 85th birthday. HERE IS A LINK to his famous song.

In an upward trending rate environment it feels like a win when I can report that mortgage rates did not increase last week. They also didn’t go down.

10-year treasury below 3.00%

After spending most of last week above 3.00% the US 10-year treasury note is currently trading at 2.94%. I am hopeful that the 3.00% level will act as a strong technical ceiling. If so, we may see mortgage rates improve by .125% or so.

Inflation

Higher prices are the primary driver of mortgage rates. That is because when inflation rises it reduces the purchasing power of dollars used to repay debt. Therefore, when inflation rises lenders charge higher rates of interest to compensate.

Earlier today the Fed’s favorite gauge of inflation, called the Personal Consumption Expenditure price index (PCE), was released. It showed that on a year-over-year basis prices rose by 2.00% which is the Fed’s target. This was moderately below expectations.

However, if we strip out volatile food and energy prices the “core” PCE increased by 1.9% which is an increase from last month when prices rose by 1.6%. The large increase is alarming and may be a signal of higher inflation in the future (and thereby higher home loan rates).

The Week Ahead

On Tuesday the latest version of the Case-Shiller Home Price Index will be released. We’ll also see new home sales and consumer confidence data.

On Friday we’ll get the all-important jobs report and gross domestic product. That will be a big day for interest rates.

I am cautiously optimistic that rates could improve assuming the yield on the US 10-year treasury note remains below 3.00%.

Current Outlook: cautiously floating.