Rates end Q1 on a positive note but higher rates likely later in the year

At the end of her life my wife has already decided to be buried at the golf course so that I visit her multiple times per week. It’s’ Masters week which means my productivity at work will decline significantly starting Thursday.

Quarterly Report

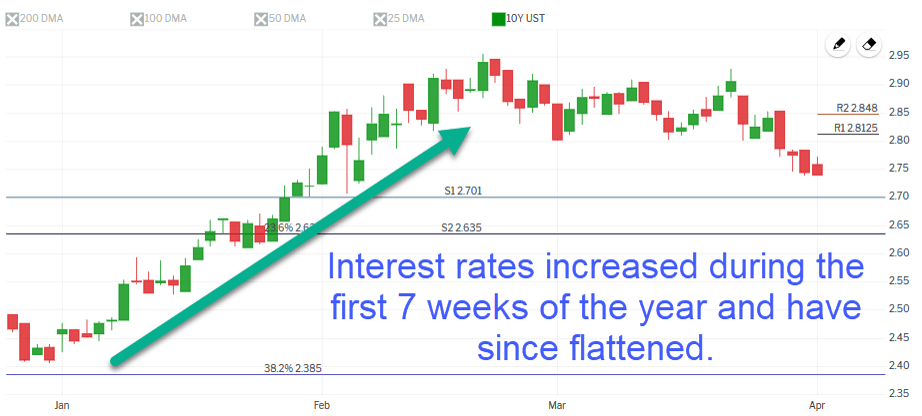

Interest rates had a tough start to the year increasing by approximately .50% during the first seven weeks. Peaking on February 21st mortgage rates have since flattened and even improved modestly.

For the quarter mortgage rates increased by about .375%.

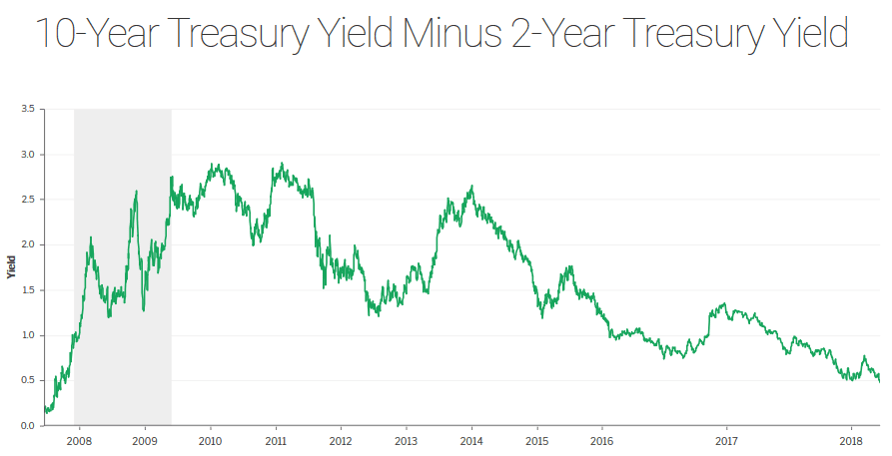

Yield Curve

The yield curve is at the flattest point since 2007. The yield curve measures interest rates over a variety of durations. The chart below depicts the difference between the yield on the 2-year and 10-year treasury notes. As the difference declines the yield curve gets flatter.

A flat yield curve is thought to forecast either an economic slowdown or higher long-term interest rates in the future. Given that the economy appears to be stable I think we are in for higher mortgage rates later in the year.

US Stocks

Home loan rates are currently benefiting from volatility in the US stock market. Equities are off ~2% again today as investors fret over the possibility of trade wars with China and regulatory backlash on tech companies. When stocks do poorly interest rates tend to benefit.

The Week Ahead

It’s the first week of a new month so we’ll get the all-important jobs report this Friday. Analysts are most interested in average hourly earnings which has remained sluggish despite low unemployment. A higher reading for hourly earnings would be unfriendly to mortgage rates. The remainder of the economic calendar is light.

Mortgage rates are presently at the lower end of their recent range so I will recommend locking.

Current Outlook: locking