Rate Update September 14, 2009

Mortgage rates are mostly unchanged from Friday.

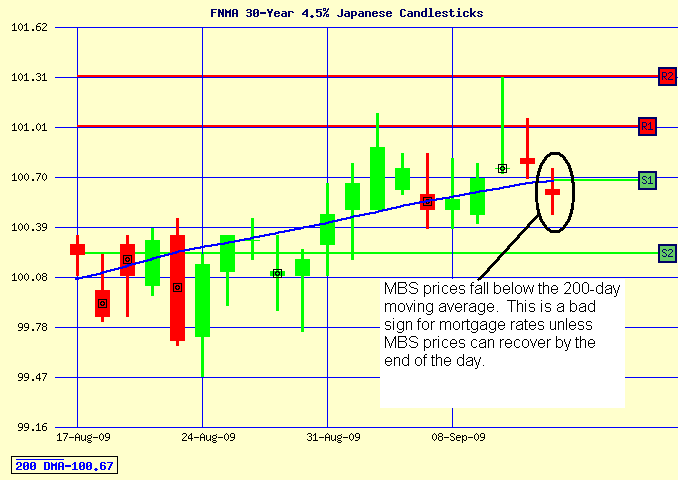

Currently mortgage-backed bond (MBS) prices are trading lower which is threatening to push mortgage rates higher.

Longer-term US Treasury prices are also lower this morning, pushing yields higher. The reason?

Some traders are speculating that China will cut back it’s demand for US fixed income securities as a punitive response to the US’s announcement over the weekend that they would impose tariffs on Chinese-made tires. China owns nearly half of outstanding US Treasury debt. So, if they decide they want to cut back on demand yields will certainly move higher (MBS yields will follow suit).

MBS prices have temporarily broken below the all important 200-day moving average so we are going to shift to a locking position.

Current outlook: locking bias