Rate Update May 29, 2008

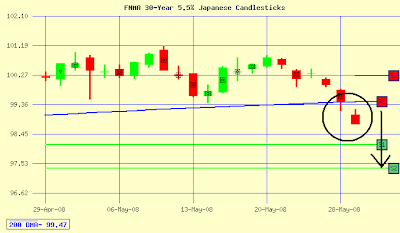

As we spoke about in Tuesday’s ‘rate update’ investor sentiment seems to transitioning away from concerns about the credit markets and into concerns over inflation. This morning the Commerce Department revised their 1st quarter estimate of GDP by .3%. This positive news for the economy has pushed mortgage-backed bond below the 200-day moving average (blue line) as shown below.

Lower bond prices results in higher interest rates which is what we’re seeing this morning. Mortgage-backed bonds had traded above the 200-day moving average for the past 9 months. The shift today may mark higher interest rates for the foreseeable future.

Current Outlook: locking