Rate Update March 7, 2008

The volatility in this marketplace continues to be unprecedented and makes it extremely difficult to predict what will happen moving forward.

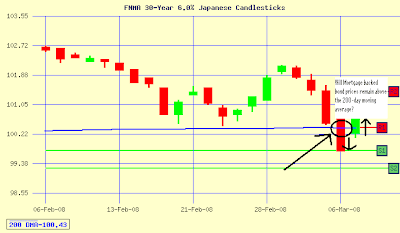

Yesterday we recommended a floating position because we felt rates would improve due to mortgage-backed bonds possibly bouncing higher off the 200-day moving average & that the jobs report would be weak this morning.

Although half of our prediction proved correct rates actually increased.

This morning’s jobs report indicated JOB LOSSES of 63,000 in February. Analysts had expected JOB GROWTH of 25,000 jobs in our economy. The news is troubling for our economy but may help mortgage rates reverse lower.

The part of our prediction that did not hold true and the reason why rates increased is that the 200-day moving average was broken (see below). Yesterday mortgage-backed bonds broke below this level and resembled a “falling knife”.

What happened? The catalyst for this move was an influx in supply of mortgage-backed securities brought to market by the Carlyle Group & Thornburg Mortgage in response to “margin calls”. For more information on what “margin calls” are please read my blog posting, “Margin Calls”.

What’s next? Currently mortgage-backed bonds have managed to creep back above the 200-day moving average. IF they can close above this level it would be a GREAT sign for mortgage rates. If not, we may not see rates this low again for a few months…..

Current Outlook: neutral