Rate Update March 20, 2008

Technical trading patterns have us concerned that we’ll see rates reverse higher over the coming days.

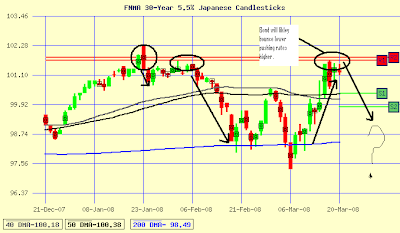

Since bouncing off the 200-day moving average (blue line) back on March 7th 30-year fixed rates have improved by about .50%.

However, the rally looks like it will be short lived. You’ll see in the chart below that the last time mortgage-backed bonds reached this level was January 22nd. Both times that bonds tried to break through this price levels they reversed lower which pushed mortgage rates higher.

Much like the 200-day moving average has been a very strong level of support this level is a very strong level of resistance. We are shifting to a locking position.

Current Outlook: Locking because of technical trading patterns in the bond market.