Rate Update March 11, 2008

Continued uncertainty about the value of mortgage-backed bonds has pressured rates higher over the previous few days. This morning the Fed stepped in to provide additional liquidity for financial institutions to buy mortgage-backed securities by increasing their “Term Securities Lending Facility”. This was a good sign but may not be enough to save mortgage-backed bonds drifting below important technical support.

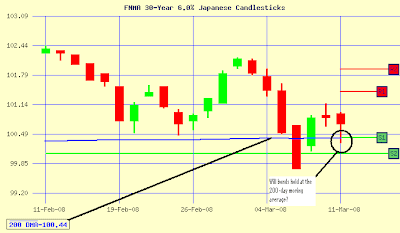

Mortgage-backed bonds have now been pushed back to the 200-day moving average. As we’ve talked about in recent days this level of technical support is critical in keeping rates around current levels. We’ll keep a close eye on the bond chart today. Should bonds dip below that 200-day moving average a locking position would be wise.

Current Outlook: very, very cautiously floating, ready to lock