Rate Update June 4, 2008

The labor department reported today that worker productivity increased greater than expected in the 1st quarter which is usually good news for mortgage rates. Despite the increase in worker productivity unit labor costs increased by more than analysts had expected. Watch today’s you tube video to understand why labor costs are an important factor for mortgage rates.

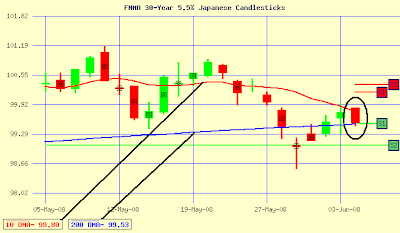

Mortgage-backed bonds are trading lower this morning and are caught in between the 10-day (red line) & 200-day moving average (blue line). We expect that bond prices will experience a “break-out” in the next few days. A “break-out” is when bond prices move sharply above or below technical trading levels and mortgage rates often move sharply as well.

Current Outlook: neutral