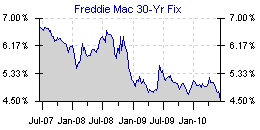

Rate Update June 18, 2010

Mortgage rates are better again this morning.

Mortgage-backed bonds (MBS’s) rallied yesterday on continued concern over Europe. In a move to clam the markets European regulators announced that they would conduct bank “stress tests” similar to the ones performed here in the US last year. If the tests are credible and show that the financial system is secure then we’d expect this to push rates higher. However, the EU has not been very transparent on details thus far so the markets have mostly ignored the news.

After rallying yesterday the fixed income markets are taking a breather. Next week we’ll brace for another $108 billion in government borrowing and a Federal Reserve meeting. At this point mortgage rates are back down at historic lows. I will shift my outlook to locking.

After rallying yesterday the fixed income markets are taking a breather. Next week we’ll brace for another $108 billion in government borrowing and a Federal Reserve meeting. At this point mortgage rates are back down at historic lows. I will shift my outlook to locking.

Current outlook: locking