Rate Update July 1, 2008

Over the past two weeks the Dow Jones Industrial Average has lost approximately $316 Billion (yes with a ‘B’) in market capitalization. This weakness in the stock market has caused 30 year fixed rates to fall by .375%. If you have not yet read this blog posting on how the stock market impacts mortgage rates it would be timely now.

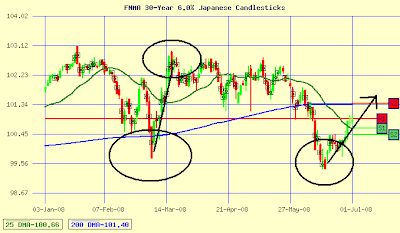

From a technical standpoint mortgage-backed bonds continue to take direction from stocks. However, I wanted to point out the graph below. The first circle at the bottom left shows the lows that mortgage backed bond prices hit at the beginning of March (during this time 30 yr rates hit 6.375-6.50%). From that low bond prices rallied over the next few days and rates dropped by .50%. Two weeks ago we also hit this low in bond prices (30-yr rates also hit 6.375%-6.50%). It looks like we are trying to rally back from these levels so we are going to maintain a floating position for now.