Rate Update December 1, 2009

Mortgage rates are mostly unchanged from yesterday.

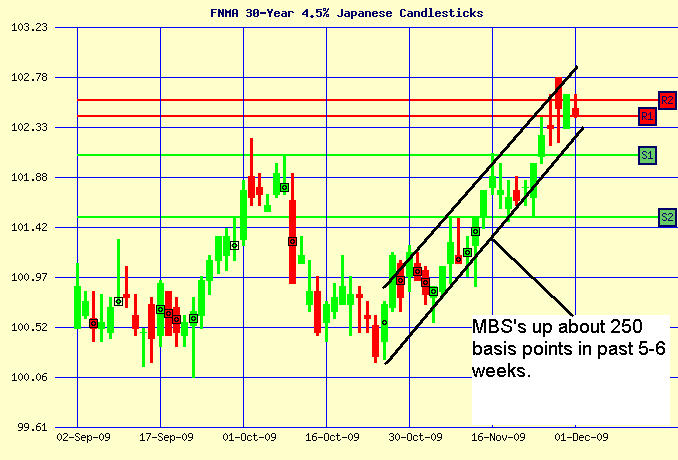

As you can see in the chart below MBS’s have managed to rally over 250 basis points in the past 5-6 weeks. Over that time 30 year fixed rates have dropped by .375%.

From a technical perspective MBS’s have appeared ripe for reversal for some time. Here on ‘rate update’ we have remained in a locking position ever since rates dipped below the 5.00% mark. Despite the fact that rates have remained at or below this level we still believe locking is a prudent play.

As anxiety eases over Dubai’s debt problems the “flight-to-safety” which helped push yields lower last Friday is continuing to ease which will put upward pressure on mortgage rates.

Australia raised it’s key short-term interest rate by .25% earlier today for a third straight month. Higher interest rates in foreign economies indirectly puts upward pressure on US interest rates.

We remain in a locking position expecting that when MBS’s begin to reverse they will likely do so at a quick pace, pushing rates up rapidly.

Current outlook: locking