Home Loan Rates stable….for now

With today being the first Monday after daylight savings I think we can all agree this is the “Mondayest” Monday of the year.

Mortgage rates stable?

Mortgage rates fared ‘OK’ last week. For the most part home loan rates were unchanged despite US stock indexes moving higher. Normally interest rates worsen when stocks do well.

Don’t look now but mortgage rates have traded within a .125% range since mid-February.

Jobs report

Last Friday’s all-important jobs report showed much stronger employment growth than was expected. However, wage growth actually slowed modestly which is probably why mortgage rates didn’t move higher on the news. Higher wages can lead to inflation which is the nemesis of mortgage rates.

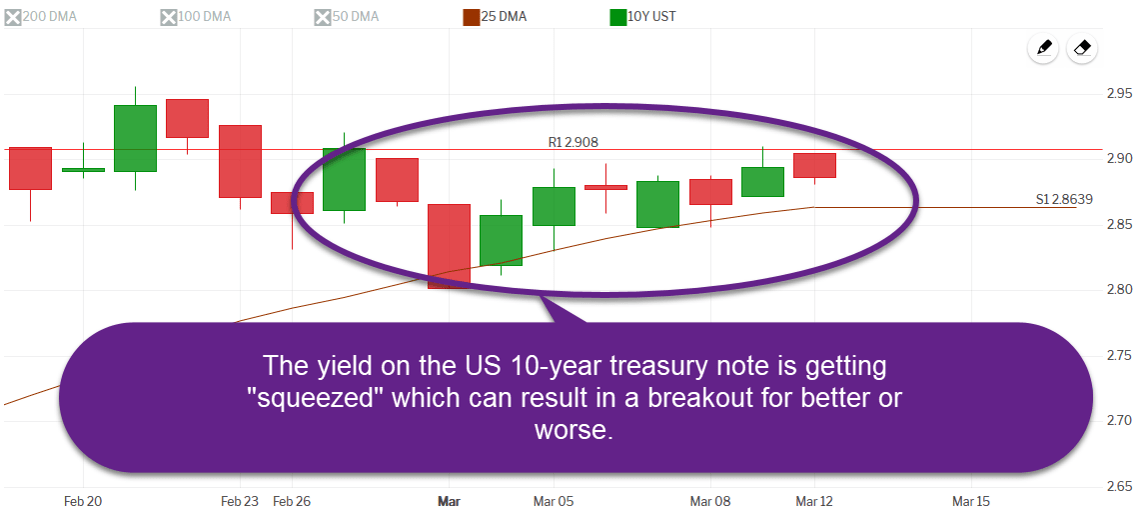

Rates getting squeezed

The technical outlook for interest rates has me concerned that we may experience a “breakout”. The yield on the US 10-year treasury note is trading in a tight range between technical support and resistance. When this happens we sometimes see yields sharply bounce outside of the compressed range.

The week ahead

This week’s economic calendar features a variety of reports that can drive interest rates. Later today the US Treasury will auction off $21 billion in US 10-year treasury notes. If demand weakens for this asset it would likely pressure home loan rates higher.

On Tuesday we’ll get the latest reading of the Consumer Price Index, on Wednesday Retail Sales, and on Thursday the Producer Price Index.

The safe play is to lock and avoid any possible breakout.

Current Outlook: locking bias