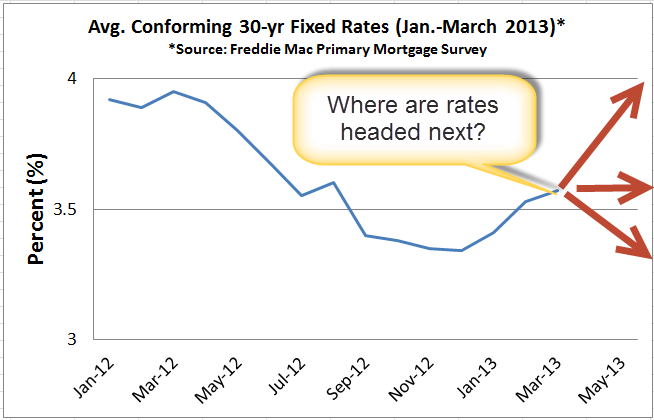

Mortgage Rate Update April 1, 2013

Mortgage rates are unchanged from Thursday last week.

Although no new developments are being reported out of Europe US mortgage rates remain about .125% better than recent highs. It’s likely that attention will refocus on the US economy this week with a number of significant economic reports on the horizon.

Earlier today a monthly gauge of manufacturing activity in the US showed weaker than expected growth. Later this week we’ll get the ADP jobs report on Wednesday, weekly jobless claims on Thursday, and the all-important jobs report on Friday. Weak economic news is generally good for interest rates and vice versa.

From a technical perspective mortgage rates appear poised to reverse higher. Rates have improved gradually over the past two weeks and it looks like that trend will reverse.

Having said that, there is a growing crowd of folks who are predicting that US stocks are poised to reverse and move lower. The S&P 500 has now gone 550 days since the last 10% correction. This is the 5th longest stretch in stock market history. Should stocks move lower we would expect mortgage rates to benefit.

This is a tough market to judge so I will take the middle ground.

Current Outlook: neutral