Might low unemployment signal a recession near?

On this day in 1896 the chief engineer of Edison Illuminating Company first test drove the “Quadricycle” he had developed. That engineer’s name was Henry Ford and the “quadricycle” would eventually be commonly known as a car.

The next stage of automobile evolution is expected to be the driverless car. CLICK HERE to learn how they may impact real estate values.

Jobs, Jobs, Jobs

Friday’s all-important employment report showed continued strength in the Labor Market. According to the release the US economy added 223,000 new jobs, average hourly wages rose, and the unemployment rate decreased to 3.8%.

Seemingly a healthy jobs market is a great indicator for the housing market. However, there are two concerns that arise from the report.

#1: Inflation & Home Loan Rates

Job growth coupled with a low unemployment rate means employers will have to pay higher wages to attract workers. This is great for employees but also can lead to wage-based inflation where producers are forced to charge higher prices.

Since inflation is the primary driver of mortgage rates strong job growth becomes a double edged sword for housing demand.

#2: Recession near?

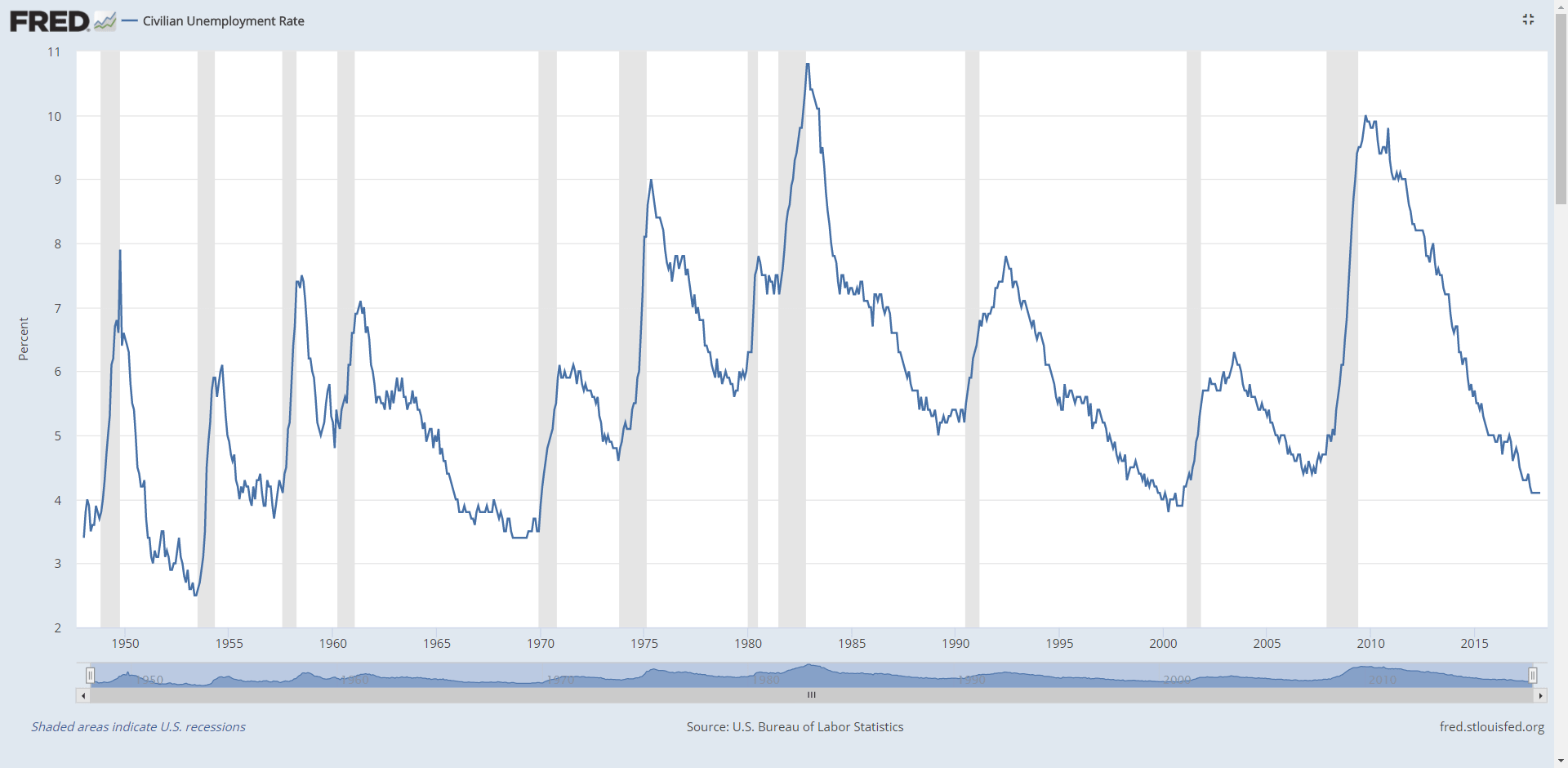

The US economy has been growing for more than eight years now making it one of the longest expansions in recent history. Dating back to World War II recessions have always followed cyclical low points in the unemployment rate as the chart above shows (grey shadowing signals recessions).

I subscribe to the belief that we are 12-24 months away from a recession. Mortgage rates tend to drop during recessions so it might make sense for homebuyers to consider 5/1 & 7/1 ARM’s at this time.

The Week Ahead

This week’s economic calendar is relatively light. The US Treasury will auction 10-year notes and 30-year bonds this Thursday. The additional supply of longer-duration securities will make it difficult for rates to improve. Furthermore, the political drama in Italy seems to be quieting down. I will recommend a locking bias.

Current Outlook: locking