Fed stays put as do mortgage interest rates

Seventy one years ago a wood raft carrying five people arrived at an island near Tahiti after a 101 day journey from Peru. The raft was captained by Norwegian Thor Heyerdahl and supported his thesis that Polynesia’s earliest inhabitants may have migrated from South America.

The story was later made popular in the best-selling book Kon-Tiki.

The Fed

It looks like it will be about 101 days from the Fed’s last rate hike to the next one.

As expected the Fed did not hike short-term interest rates last week. According to CME Group there is a 93% probability that the Fed will hike by .25% when they meet in mid-September. The Fed last hiked short-term interest rates back in mid-June.

As a reminder the Fed does not directly control mortgage rates but their comments and actions can influence them.

Jobs Report

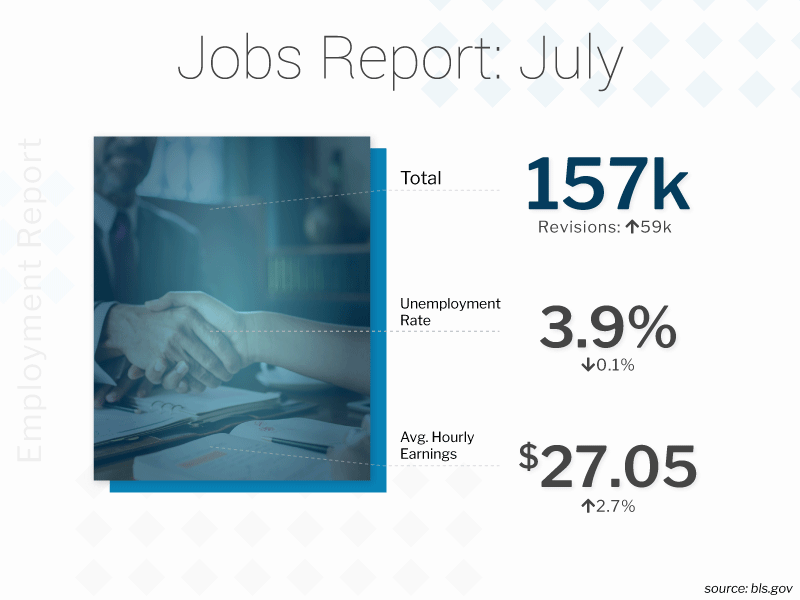

This past Friday the Labor Department released its monthly employment report. It showed that the US economy created 157,000 jobs during July and wages grew modestly.

With the unemployment rate at 3.9% the labor market is deemed to be tight which we would expect to pressure wages higher. If wages grow too quickly then it could lead to inflation which is not friendly for mortgage rates.

The Week Ahead

Speaking of inflation it is about the only significant event scheduled for release this week. On Thursday we’ll get a look at the Producer Price Index and on Friday we’ll get the latest reading of the Consumer Price Index.

In the absence of a heavier economic calendar I would expect interest rates to react to technical trading patterns. The technical signals suggest it will be much harder for rates to improve this week than for them to worsen. I would recommend carrying a locking bias into the latter half of this week.

Current Outlook: locking