Despite stock market losses home loan rates rose last week

The winter Olympics are fully underway in South Korea and I find it inspiring to watch all the athletes who have trained tirelessly for the past four years to compete for gold. My idea of training? I named my dog six miles so I could tell people that ‘I walked six miles today’.

Typically when stocks perform poorly interest rates benefit. Last week the US stock market lost ~5% of its value yet interest rates continued to march higher. Why?

S & D

I wrote about the topic last week and I am going to harp on it again. One of the primary factors pressuring interest rates higher is supply and demand.

The supply of US Treasury notes is expected to increase following passage of the tax reform bill and the latest two-year federal budget. Both create substantial deficit spending which will have to be financed with a greater supply of US debt.

Meanwhile, demand for US Treasury securities is expected to decline as central banks around the world cut back on quantitative easing measures which are a legacy of the great recession.

An increase in supply met with a decrease in demand drives prices lower which in turn pressures yields higher.

Four-year highs

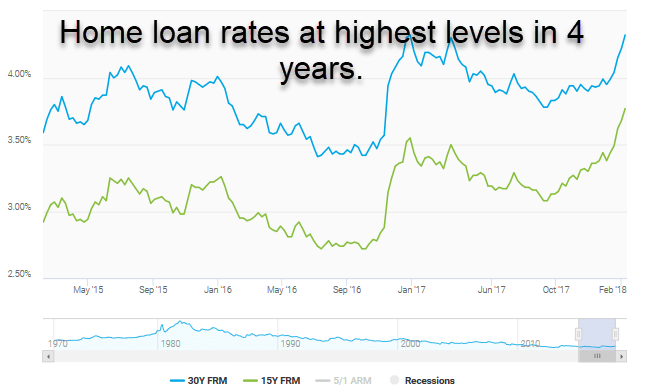

The average rate for a conventional 30-year fixed rate mortgage is now at the highest level since 2014. 15-year fixed rate loans are at the highest level in over five years.

Since September mortgage rates have increased by over .50%. A .50% increase to interest rates has the same impact on mortgage payments as home appreciation of 6%. In other words, even without appreciation homes “feel” more expensive for buyers.

Interestingly, according to a recent survey only 6% of respondents said they would cancel their plans to buy a home if mortgage rates surpassed 5%.

The week ahead

The meat of this week’s economic calendar kicks off Wednesday with retail sales and the Consumer Price Index. On Thursday we’ll get industrial production and the homebuilders’ index. On Friday we’ll see housing starts and consumer sentiment.

The technical outlook is mixed. Interest rates are currently trading at important technical levels that could help them reverse and move lower. However, recent momentum is too much for me to ignore so I will maintain the locking position we;ve held for the past month.

Current Outlook: locking