A busy week for housing, for home loan rates 2.91% is key

One of my favorite days of the year took place on Saturday when Berkshire-Hathaway released its annual shareholder letter. If you have never partaken in Warren Buffett’s simple, humorous, and sage advice I encourage you to dive in HERE. Have kids? This is all the financial education you need to give them.

Mortgage Rates

Mortgage rates held steady last week and even improved modestly for 30-year fixed rate amortizations. I had written about the significance of the US 10-year treasury note yielding 2.91%. Fortunately that technical level did hold and today it is trading at 2.86%. As long as it trades below 2.91% I expect mortgage rates to hold steady (and possibly improve?).

Housing Data

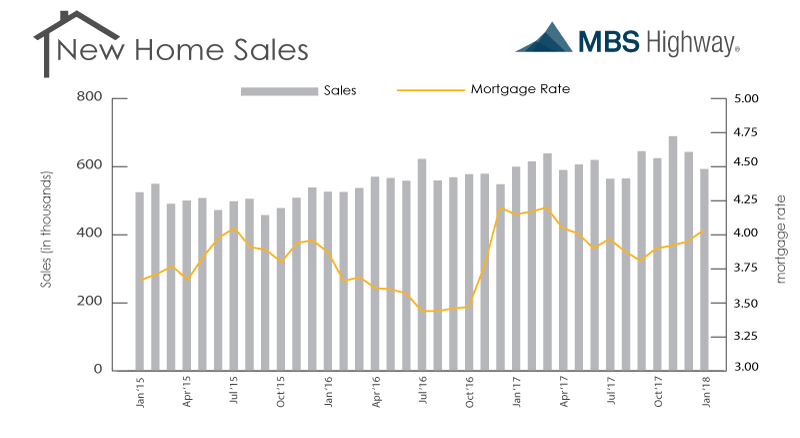

This week’s economic calendar will tell us a lot about housing. Earlier today new home sales were reported below economists’ expectations. However, they are coming off record highs reported in November of 2017.

On Tuesday we’ll see the most current home price index reports from Case-Shiller and the FHFA. On Wednesday the National Association of Realtors will release the latest pending home sale report.

The Fed

New Fed Chairman Jerome Powell will address lawmakers on Capitol Hill for the first time on Tuesday and Thursday. Larger projected government spending deficits have increased speculation that inflation pressures will rise. Inflation is the primary driver of home loan rates so we will be listening closely to his comments.

The Outlook

As long as the yield on the US 10-year treasury note remains at or below 2.91% I feel comfortable floating. However, longer-term trends are still concerning so my advice is use caution this week.

Current Outlook: cautiously floating