The Truth About Mortgage Loan Points

Like many other money-related decisions that consumers inevitably encounter throughout their financial lives, the question of whether or not to pay points when taking out a new mortgage is one with dogmatic opinions on either side of the debate. A quick web search will turn up compelling reasons both for and against the act. So how do you determine if paying points is a smart decision for you?

Before I explain my approach for helping consumers make the best choice, let’s first define “point” in a mortgage industry context. One point is equal to 1% of the amount of a new loan and is a fee that is included with the other closing costs and paid when the loan is originated. For example, on a $200,000 loan, the 1% point loan fee would be $2,000.

In exchange for paying a 1% point fee upfront, borrowers receive a permanent discount to their interest rate. For fixed-rate mortgages, the discount typically is 125% to .375%. For adjustable-rate mortgages (ARMs), the discount is often a little greater, usually .25% to .50%. Most of the time, points are expressed in round numbers (i.e., 1% point, 2% points, etc.) but points can also be expressed in decimals (i.e., .50% points) and as negative numbers. (A -1% point would act as a lender credit toward the borrower’s closing costs.) Points are always expressed as a percentage of the loan amount, not the purchase price.

In order to determine if it makes sense to pay points, borrowers need to address the following questions:

- Can I afford to pay the point(s)?

- If so, then how much interest do I stand to save over the expected life of the loan by investing in the point(s) upfront?

In answering the first question, it’s important to be sure that the borrower not only possesses enough money to pay the additional upfront fee, but also has enough money left over to have an appropriate financial cushion. It’s worth noting that points are eligible to be paid through a credit provided by the seller in a purchase transaction, or they can be financed into the loan amount in a refinance.

Nearly all mortgage professionals can provide a straightforward calculation to help borrowers determine how much interest they may save by investing in points upfront. Let’s look at a simple example. Assume the following:

- Loan amount: $200,000

- Loan program: 30-year fixed-rate mortgage

- Rate available with 0% points: 5.00% (principal & interest: $1,074)

- Rate available with 1% point: 4.75% (principal & interest: $1,043)

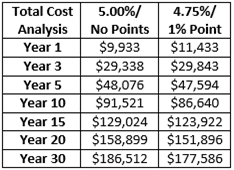

The chart below represents an accounting of the points and accumulated interest paid (total cost) at various stages throughout the life of the mortgage.

As the chart demonstrates, if a borrower only elects to keep the loan for three years or less, then paying points would not benefit that borrower. In fact, by not paying points and accepting a higher interest rate, the borrower would pay approximately $500 less ($29,338 versus $29,843) on the mortgage. However, if the borrower plans to hold the loan for its entire term, then he or she would save nearly $9,000 ($177,586 versus $186,512) by investing in a point upfront and obtaining a lower fixed rate.

In general, the longer a borrower intends to keep a mortgage, the more sense it makes to pay points. Furthermore, a borrower who is more focused on creating a low payment may value the cash-flow savings of paying points more than the long-term cost-benefit analysis.

Paying points typically does not make sense for borrowers who intend to pay off their loans at a faster pace than the amortization schedule or for those who plan to only keep the loan for a short period of time.

Another important consideration in the points decision is the time value of money. Simply put, a dollar saved today is worth more than a dollar saved in the future. For borrowers who prefer a truly comprehensive comparison, I recommend discounting the future cash-flow by an appropriate rate (i.e., the historical inflation rate).

In summary, there is no universal right or wrong answer as to whether or not paying points makes sense; the situation is different for each borrower. To make a prudent decision, consider your current financial state, the savings you may or may not gain from paying points upfront, how long you’re likely to hold onto the loan, and how quickly you plan to pay it off. You can always ask for help from a mortgage professional—that’s why we’re here.