While snow falls mortgage rates rise

I didn’t expect to see this much snow falling when I got up this morning. Now I am just waiting for a tweet from the President accusing the National Weather Service of failing to predict this storm because they were too focused on the Russia investigation.

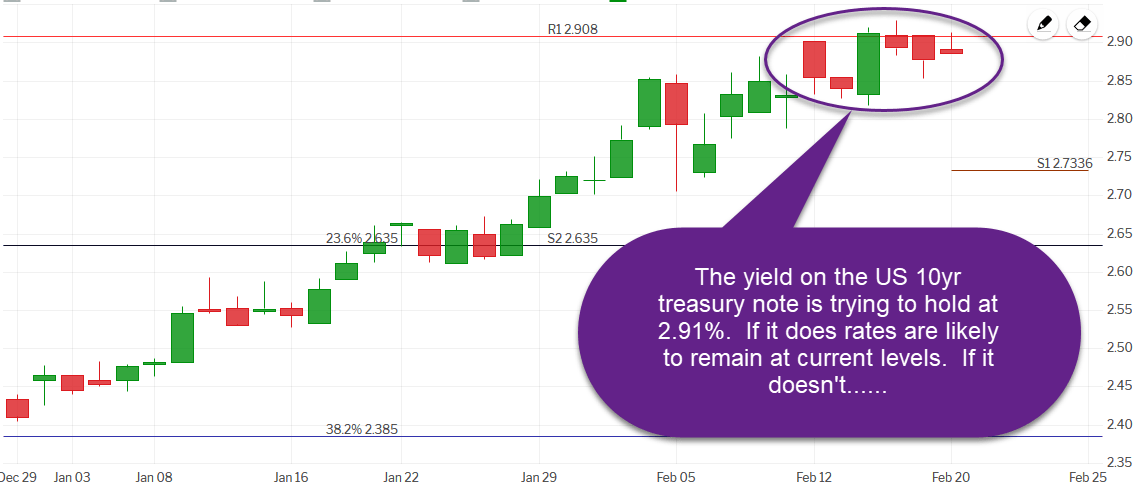

Do you know what isn’t falling? Interest rates. Mortgage rates rose another +.125% last week. Might we finally get some reprieve and see rates stabilize or remove lower? The answer to this question will largely depend on the US 10-year treasury note.

Mortgage rates tend to track changes in yield on the US 10-year treasury note. For example since the beginning of the year the yield on the 10-year treasury note has increased by +.50% and mortgage rates have increased by about the same.

The US 10-year treasury note is currently trading very close to 2.91%. It has traded very near this level since last Monday but has not managed to break through. Assuming this technical layer of resistance can hold I would expect mortgage rates to remain at current levels.

If the yield on the US 10-year treasury note breaks above the 2.91% level I expect mortgage rates to worsen by another .125%.

This week’s economic calendar features bond auctions from the US government. As I have written about (HERE) we are beginning to see the supply of treasury auctions increase which will make it harder for mortgage rates to improve.

I will remain in a locking position.

Current Outlook: locking