Mortgage Rate Update December 17, 2015

Mortgage rates worsened slightly Monday & Tuesday this week but have since rebounded so that we’re currently unchanged on the week.

Unless you live under a rock you are well aware that, as expected, the Fed did raise short-term interest rates by .25% yesterday. The move will increase the borrowing costs on loans based on the Prime Index such as credit cards and home equity lines of credit but does not directly impact mortgage rates.

In conjunction with announcing the increase the Fed said they were likely to continue to bump short-term interest rates higher at a “gradual” pace. What does that mean?

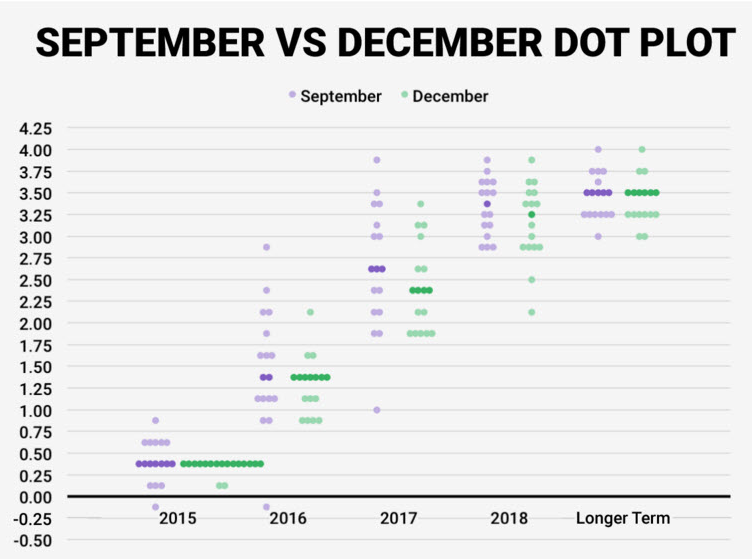

A look at the “dot chart”, which is a graphical representation of the various Fed members’ forecasts for future rates, the markets currently believe the Fed will bump rates by .25% 4 times in 2016 and 2017.

From a technical perspective mortgage rates are trading within a fairly tight range which leads me to believe that rates will likely trade sideways. That said, next week is a holiday shortened week and it’s likely that trading desks will sparsely occupied so starting Monday we run the risk of seeing some volatility. I would recommend locking before the week is out.

Current Outlook: locking before the week is out