Might this Friday’s jobs report signal an imminent recession?

On this day in 1963 a toy company in California that initially experienced success by marketing the “Pluto Platter”, which later became known as a Frisbee, filed patent for their next big product.

25 million units were sold in the first four months and set off a huge fad across American culture. What was the product?………the hula hoop.

Mortgage Rates

Interest rates continue to circle around 9-month lows but there are some signals which suggest interest rates could trend higher.

US-China Trade Talks

According to multiple sources US and Chinese negotiators are close to finalizing a new trade deal between the two economic powers. For months there has been uncertainty about the economic impact of US-China trade relations.

Uncertainty tends to help US mortgage rates improve so by removing the uncertainty I think we will see upward pressure on US interest rates.

Jobs Report

It’s jobs week which means we’ll see the ADP employment report on Wednesday, jobless claims numbers on Thursday, and the all-important jobs report from the Bureau of Labor Statistics this Friday.

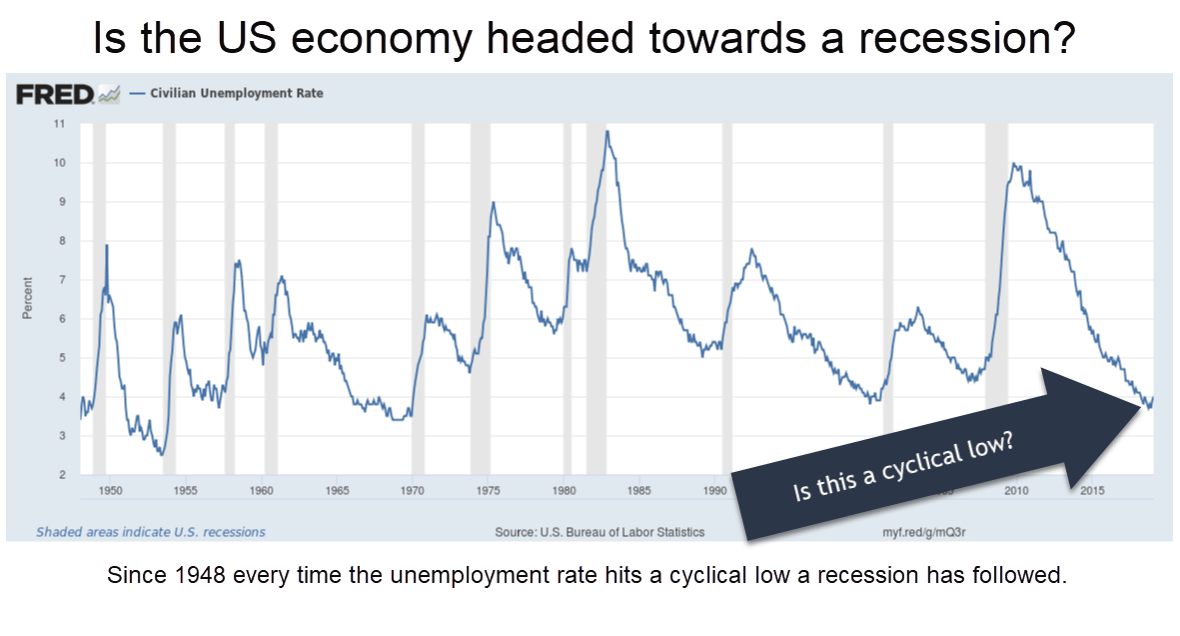

The markets are currently expecting 175,000 new jobs created for February. However, I will be paying special attention to the unemployment rate in this month’s release.

The unemployment rate hit a low of 3.7% in September and November of 2018. Since then it has increased to 3.9% in December and 4.0% in January.

If the unemployment rate continues to trend higher then I think an economic recession is imminent. As the graph above shows every time the unemployment rate has established a cyclical low a recession has followed.

The potential good news is that mortgage rates tend to improve during economic recessions.

Outlook

Although mortgage rates may benefit from a recession the current economic headlines are not interest rate friendly, so I am going to recommend a locking bias.

Current Outlook: locking