Mortgage rates continue to trend higher

Today marks the 17th anniversary of the horrible 9/11 attacks. Virtually every US citizen’s life were altered that day. If you’ve never heard the incredible and inspiring story of Welles Crowther (AKA “the man in the red bandana”) I encourage you to take a moment to watch THIS today.

Mortgage Rates

Last week I recommended locking and that proved to be the right call.

Since the end of April conventional 30-year fixed rates have traded within a range of 4.625%-4.875%. As recently as August 24th mortgage rates were available at the lower end of that range but as of today we are at the top end.

The last few times mortgage rates have hit these levels they have reversed lower. I am not confident that pattern will repeat itself this time.

The Fed

The Fed is scheduled to meet in two weeks and according to CME Group there is currently a 98% chance they hike rates by +.25%. It is basically a certainty.

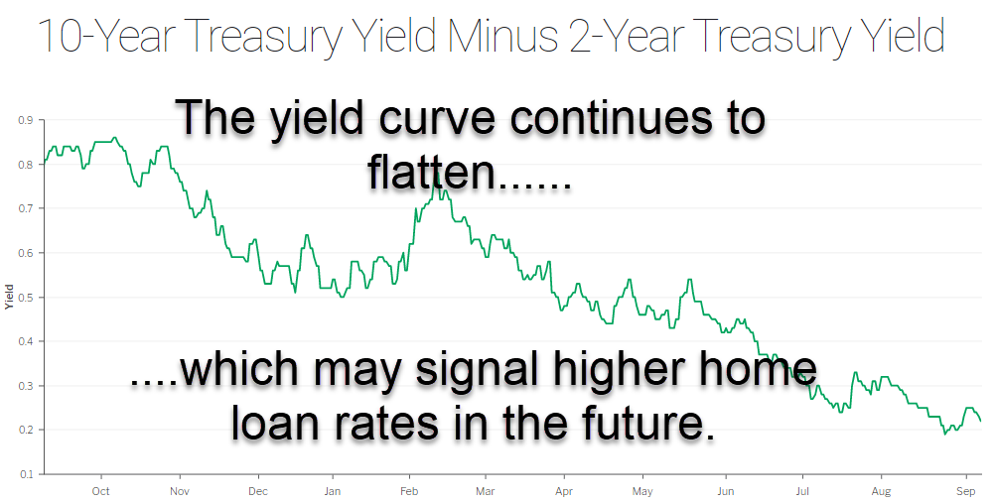

Yield Curve

As of today there is a .22% difference between the yield on the US 10-year treasury note and the 2-year treasury note. After the Fed hikes rates in two weeks we could see the yields on par which means we’d have a flat yield curve.

If this happens I would either expect an economic recession in the next 12-24 months or longer-term interest rates to increase (including for mortgages).

On a side note the flattening of the yield curve is also reducing the difference between 30-year and 15-year fixed rate mortgages. There is currently only a .25% advantage for 15-year amortizing loans.

The Week Ahead

There are a number of Fed officials speaking this week and their comments can always influence the markets. On Thursday we’ll get the latest Consumer Price Index report and on Friday we get the latest reading for Retail Sales.

Momentum is not on our side. I think mortgage rates will worsen by another .125% before stabilizing. I will maintain a locking bias.

Current Outlook: locking