Government Shutdown Pauses Mortgage Rate Momentum

After two days of the government being shutdown it looks like congress has reached an agreement to fund Federal operations. Just wondering, if this happens again can we ask Canada to govern us?

According to estimates a government shutdown costs the US economy $1 billion per day. Bad news for the economy is often good news for mortgage rates.

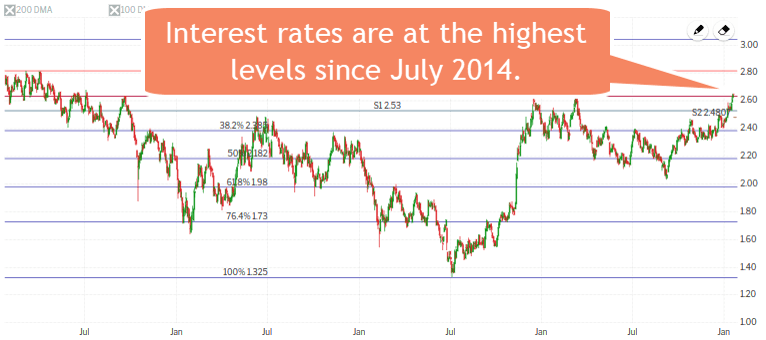

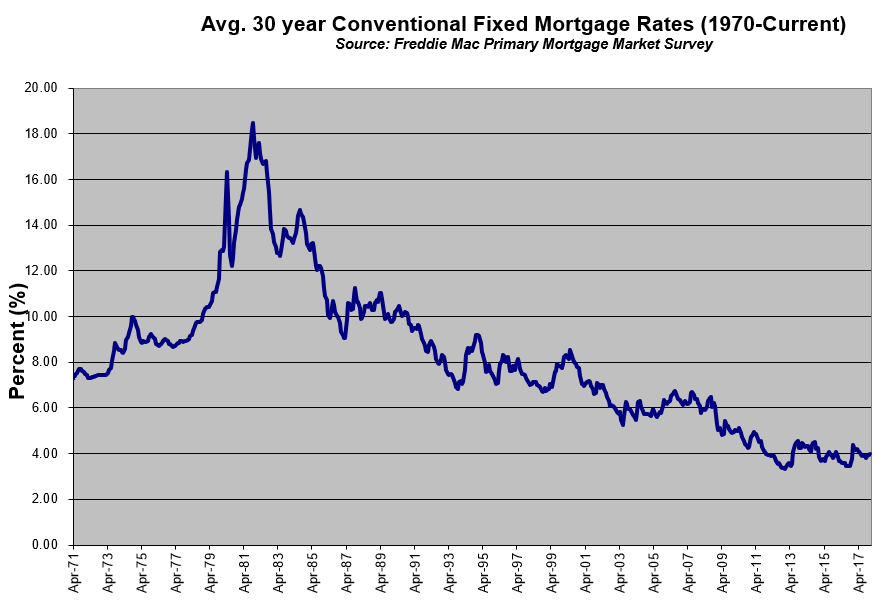

Home loan rates need the help because last week they continued to march higher. Interest rates in the US are currently at the highest level since July of 2014. Let’s not lose perspective though, mortgage rates are still historically low.

Furthermore, most experts predicted that mortgage rates would rise in 2018 so this should come as no big surprise.

This week’s economic calendar is relatively light (aside from the government shutdown). On Wednesday we get existing home sales and the FHFA house price index. I expect the latter to reflect continued appreciation due to lack of supply. On Thursday we get the latest reading on new home sales and on Friday durable goods orders.

Assuming that the government funding agreement comes together today I am going to maintain a locking bias. Momentum is not on our side.

If not the uncertainty of the shutdown could help mortgage rates improve in the near-term.

Current Outlook: locking