Mortgage Rate Update July 12, 2012

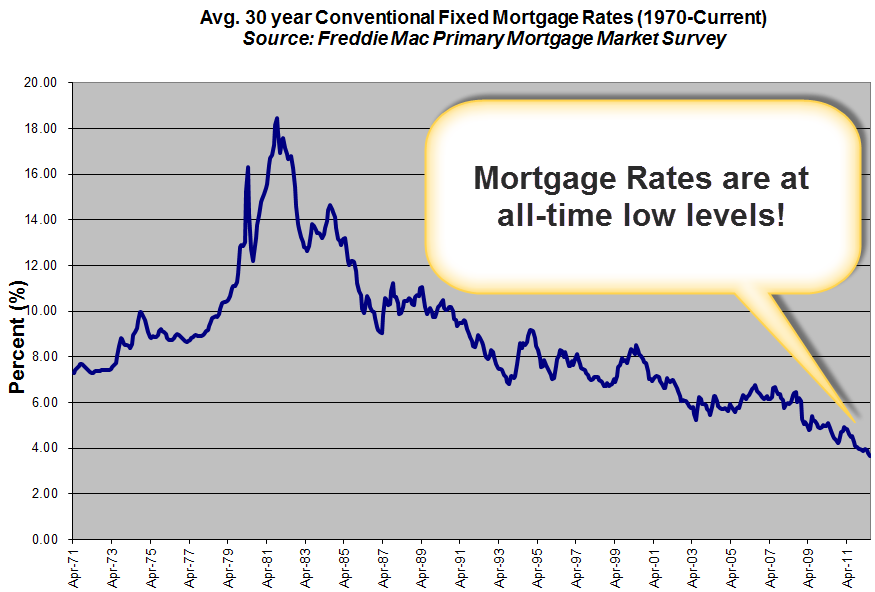

Mortgage rates remain at all-time low levels.

There are no new developments regarding the European debt crisis. Germany has yet to concede on a bold plan to “co-sign” for the periphery economies which would likely cause US interest rates to reverse higher.

Meanwhile, the Euro currency trades at the lowest level versus the US dollar in 2 years. The bottom line is that the European debt crisis continues to drag down the global economy causing investors to pile into “safe-haven” assets such as US-denominated debt securities, which has the impact of driving rates lower.

The Federal Reserve released minutes from their last monetary policy meeting yesterday. It revealed that the committee acknowledges the negative impact of the European debt crisis on the economy but fell short of committing to another round of quantitative easing designed to drive long-term rates lower.

My personal opinion is that the Fed has little left in their tool set. Long-term interest rates are already at all-time low levels so what would further easing accomplish?

From a technical perspective the US 10yr Treasury yield is butting up against resistance at 1.44%. I believe rates may retrace higher from here until there is any further development in Europe.

Current Outlook: near-term locking bias (<21 days), long-term floating (>21 days)