Interest rates and US stocks got off to a good start last week but had a rough finish. For the week mortgage rates worsened very modestly.

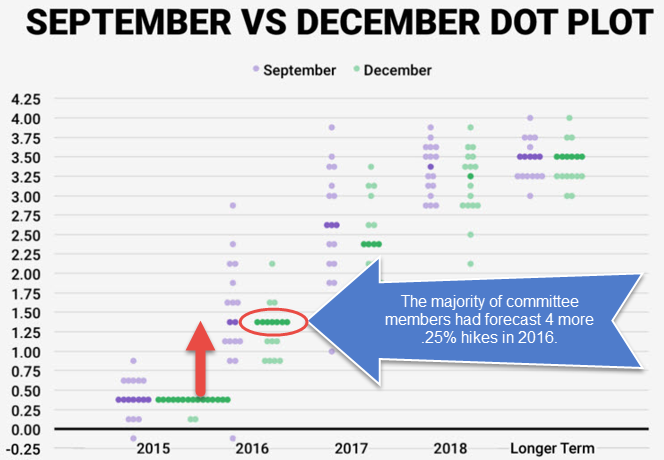

We are 30 days away from the next Fed meeting and according to CME group there is currently a ~97% probability that the Fed will hike short-term interest rates. I am guessing media coverage will pick up on this topic after the Thanksgiving Holiday.

As a reminder the Fed does not directly control mortgage rates. The Federal Funds Rate is charged on overnight loans between banks and a mortgage can last 30 years.

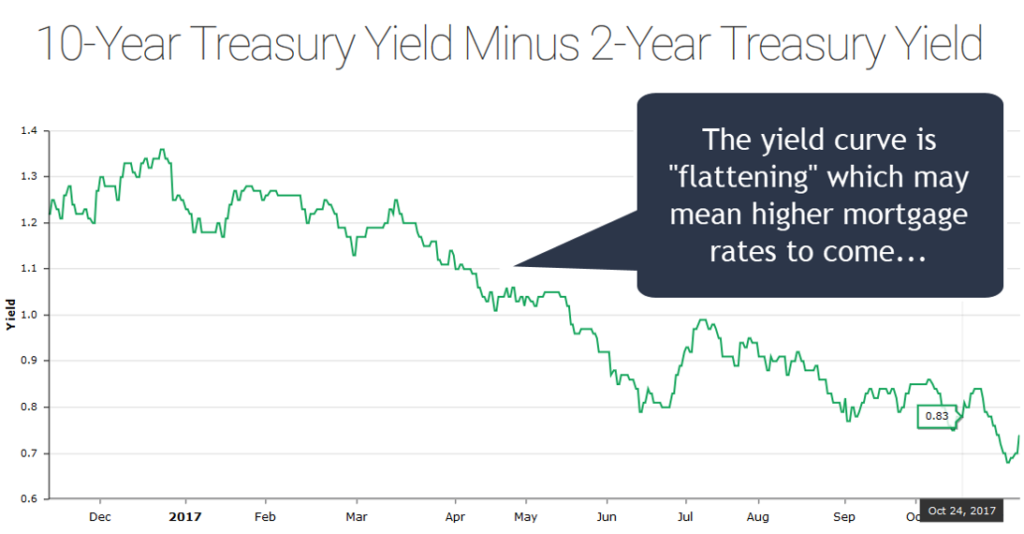

What’s interesting is that as the Fed has hiked short-term interest rates yields for shorter-term loans (i.e. less than three years) have increased yet longer-term durations have remained relatively low. A look at he spread between the 2-year and 10-year treasury notes tell the story:

The yield curve is “flattening” which may mean long-term rates, including mortgages, will rise in the future or could also signal a recession. Time will tell.

As I had written about last week (see HERE) sentiment regarding the tax overhaul is driving the direction of the financial markets. I expect much of the same this week.

The Senate version of the tax overhaul legislation, which was released on Thursday, will now be reconciled with the House version. Given the vast differences investors now seem pessimistic that a compromise will be made. Given that the tax overhaul is seen as inflationary this could actually help interest rates remain low……for now.

The economic calendar is busy this week. Although we lost ground last week I will remain cautiously floating.

Current Outlook: cautiously floating