Mortgage rates slightly improved

Feeling busy and anxious about all the things you have to get done?

Just remember, “stressed” spelled backwards is “dessert” and today is National Vanilla Ice Cream Day!

Interest Rates

Home loan rates have improved modestly from last week.

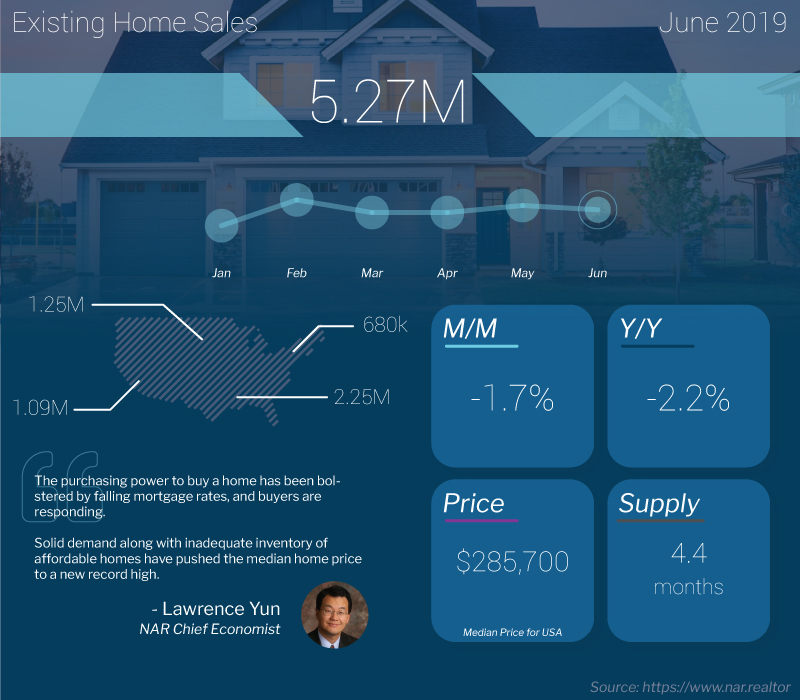

Existing Home Sales

The National Association of Realtors released figures earlier today which showed that the number of existing home sales slid 2.2% in May compared to a year earlier. Despite low mortgage rates and a strong labor market a lack of housing supply is causing the number of units sales to decline.

Home Prices

According to the aforementioned report the median home price in the US increased for the 88th consecutive month. A median priced home increased by 4.3% compared to a year earlier and is at historic highs.

The Fed

The Fed is scheduled to meet next week and is widely expected to cut short-term interest rates. The markets are currently predicting a .25% cut but some think the Fed may come up and slash rates by .50%.

This rate cut is already baked into the rates consumers see today. As a reminder, the Fed does not directly set mortgage rates.

Outlook

From a technical perspective mortgage-backed bonds have some room to rally which would help interest rates improve.

The remainder of this week’s economic calendar is relatively quiet.

Current Outlook: floating bias