Mortgage rates are better than fluffernutter!

What do you get when you add peanut butter to marshmallow? Well if you add them to two pieces of bread you have yourself a fluffernutter sandwich and today is National Fluffernutter Day! Never tried one but if I did I would probably add bacon. Doesn’t that sound good?

Mortgage Rates

Home loan rates are good this week and are benefiting from a deterioration in US-China trade talks. The two countries are scheduled to meet this week but on Monday the US Commerce Department added 28 Chinese companies to an export blacklist which will make an agreement all that much harder to achieve.

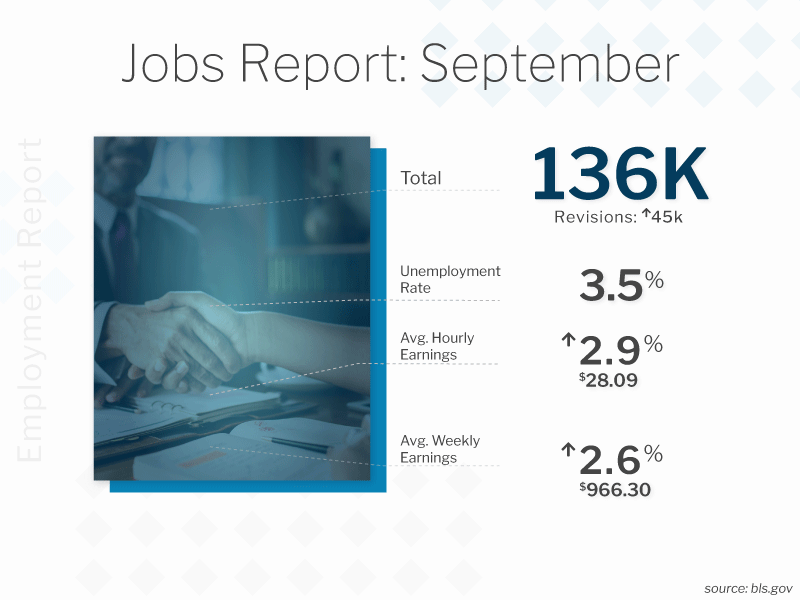

Economy

Last week’s all-important jobs report showed weaker than expected hiring. Furthermore, a reading of service sector activity also showed weaker than anticipated results. Earlier today, the head of the International Monetary Fund warned that, “the global economy is now in a synchronized slowdown.”

Bad news for the economy tends to be good news for mortgage rates.

Federal Reserve

We may learn more about the Fed’s economic outlook on Wednesday when the minutes from their last monetary policy meeting are released. The financial markets currently think there is an 80% probability that the Fed will cut again at the next meeting scheduled for October 30th.

Outlook

The economic calendar is relatively light this week which means mortgage rates will likely respond to technical trading patterns and sentiment surrounding US-China trade relations.

Mortgage-backed bonds are currently trading at an important technical layer. If bond prices can rally and close above this level then it would be a positive signal for rates. However, if bonds sell-off then it’s likely rates will trend higher the remainder of the week.

Current Outlook: cautiously floating