Divide between 10-year treasury and mortgage rates grows

On this day in 1961 East German Soldiers began laying barbed wire and bricks in downtown Berlin.

Over the course of the next 12 years the Berlin Wall was constructed. The 96-mile long wall made of concrete blocks and barbed wire was meant to divide Soviet controlled east Berlin from US-allied West Berlin.

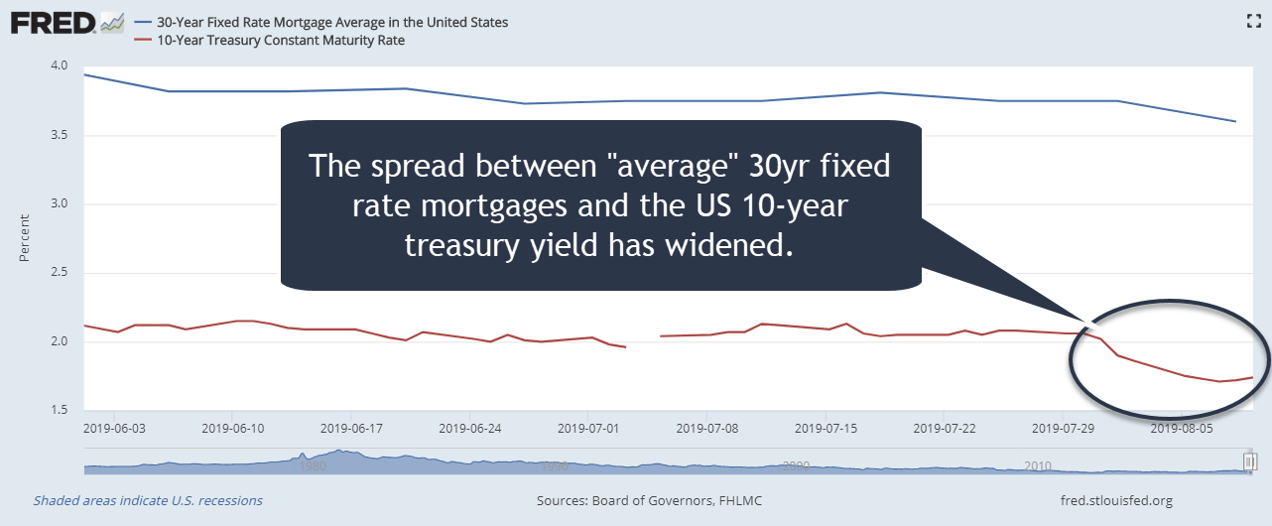

Speaking of divisions we are seeing a divide growing between mortgage rates and the US 10-year treasury note.

10-Year Treasury Note & mortgage rates

Since August 1st the yield on the US 10-year treasury note has fallen by .40% (from 2.05% to 1.65%). Normally we’d expect to see 30-year fixed mortgage rates improve by .25%-.375% when the 10-year treasury yield improves this much.

However, since August 1st mortgage rates have only improved by .125%. The spread between the US 10-year treasury yield and fixed mortgage rates is wider than normal and I expect either mortgage rates to improve further or the yield on the treasury to rise so that the spread normalizes.

Yield Curve

Speaking of the US 10-year treasury note… it is yielding 1.68% as of this morning. The yield on the US 2-year treasury note is trading at 1.65%. Should the yield on the 2-year treasury note exceed the 10-year yield then you will definitely hear about it from the media.

The yield curve has not been inverted since 2007. Going back 40 years every time the yield curve has inverted (1978-1982, 1989-1990, 2000-2001, and 2006-2007) a recession has followed (1981-1982, 1990-1991, 2001, 2008-2009).

Recessions

Although the most recent economic recession was tough on housing (or was housing touch on the recession?) previous recessions were not.

In fact, during the 1981, 1990, and 2001 economic slowdowns the S&P Case Shiller home price index actually rose during that time. Therefore, if you are a prospective homebuyer and think homes will get cheaper in the near-term I wouldn’t hold my breath.

Outlook

I still think (and am hopeful) home loan rates will improve as the spread between the US 10-year treasury yield and mortgage rates tighten. I will remain in a floating position.

Current Outlook: floating bias