I hope this video is helpful. Please feel free to share with others!

Category: Economics & Interest Rates

The Fed does not set mortgage rates

Later today the Federal Reserve Bank Open Market Committee (FOMC) is widely expected to hike short-term interest rates. Contrary to popular belief a Fed rate hike could actually help mortgage rates improve.

To understand why one must consider the reason why the Fed is hiking rates in the first place.

The Fed has a dual mandate which is to maintain:

- maximum employment

- stable prices and moderate long-term interest rates

Interest rate hikes are a tool the FOMC uses to help stabilize prices (AKA curb inflationary pressure). Inflation is the primary enemy of mortgage rates because it erodes the purchasing power of the money used to repay the loan.

Consider if you were planning on lending someone money today and deciding on what rate of interest to charge. If you were informed that the value of the money repaid to you in the future would have less purchasing power due to inflation you would be prudent to add that additional cost into the interest rate.

As the Fed hikes short-term interest rates it should theoretically prevent future inflationary pressure which is good for home loan rates.

The FOMC does not directly set mortgage rates. The rate they control is called the Federal Funds Rate and practically speaking has a very obscure function (it is the interest rate charged between banks to lend reserve balances for overnight depository requirements).

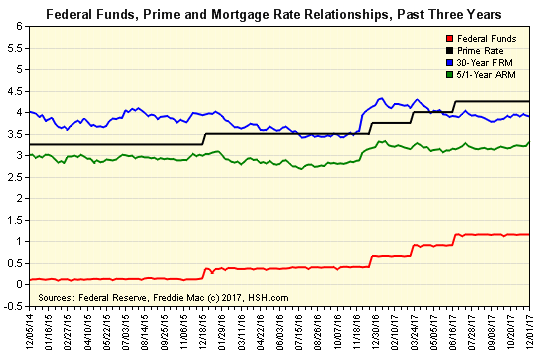

As the chart below shows there is no direct correlation between the Federal Funds Rate and mortgage rates.

As you can see from December of 2014 to December 2017 the Federal funds Rate increased from ~.25% to ~1.25% as a result of four separate rate hikes. At the start of that time period conventional 30-year fixed rate mortgage rates were averaging 4.00% and now? Still ~4.00%.

It’s important to note that the FOMC’s comments and actions can send ripple waves through the financial markets and can influence the direction of mortgage rates, for better or worse, but the Fed does not directly control the rates provided on home loans.

January 2014 jobs report stinks- mortgage rates should benefit

The heavily anticipated monthly jobs report from the Bureau of Labor Statistics is out and it stinks. The all-important monthly report showed that only 74,000 new jobs were added during the month of December. This is far below expectations of ~200,000. A weaker than expected jobs report tends to be a good sign for mortgage rates. I will post an updated ‘rate update’ on Monday so stay tuned!

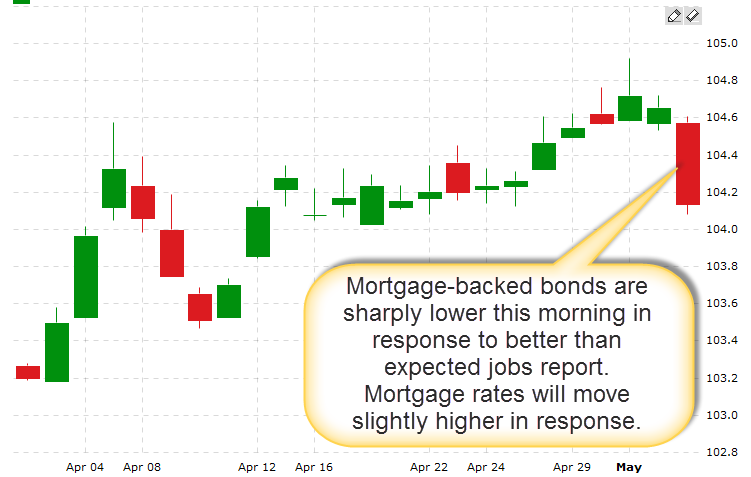

Jobs report better than expected, mortgage rates likely to worsen

This morning’s all-important jobs report showed the US economy added 165,000 new jobs in April. This figure was more than analysts had expected. The financial markets are reacting as expected. US stocks are trading higher and bonds are trading lower which will likely pressure interest rates higher.

Mortgage Rates Dip to All-Time Lows

Average 30-year fixed mortgage rates have remained below 4.00% (APR: 3.875%) for 6 weeks now according to Freddie Mac’s Primary Mortgage Market Survey released today. When you view the current level of mortgage rates from a historical perspective it becomes clear what an incredible opportunity this presents (see chart below which depicts average 30-year fixed mortgage rates over the past 41 years).

Even with rates at all-time low levels I still get asked by customers if they should hold-off and wait for rates to move even lower. It’s extremely hard to imagine that mortgage rates will improve significantly from these levels but not many in our industry thought they would ever get this low in the first place and yet….here we are.

Even with rates at all-time low levels I still get asked by customers if they should hold-off and wait for rates to move even lower. It’s extremely hard to imagine that mortgage rates will improve significantly from these levels but not many in our industry thought they would ever get this low in the first place and yet….here we are.

So what factors will play a role in determining the direction of rates over the next few weeks and months? The European Debt Crisis and our own economic recovery are the two main drivers that we’ll be watching.

The European Debt Crisis, which has been around for nearly two years at various levels of intensity, impacts mortgage rates because when investors around the globe lose confidence in the Euro-zone’s ability to repay its obligations they seek “safety” in US-dollar denominated assets, including mortgage-backed bonds (MBS’s). The additional demand for MBS’s causes mortgage rates to improve. Should investors grow optimistic about the EU’s ability to dig themselves out of their fiscal hole without too much collateral damage to the economy then mortgage rates here in the US will likely increase and vice versa.

Meanwhile, a sluggish economic recovery here in the US has also helped mortgage rates remain low. This is because interest rates are sensitive to inflationary pressure. When lenders expect prices to climb in the future they charge higher rates of interest to compensate for the anticipated decline in purchasing power. Until our economy shows convincing signs of continual growth inflationary pressure should remain tepid which should help mortgage rates remain low. However, at some point the economy will pick up again and at that time we expect inflation and therefore mortgage rates to tick up as well.

Accurately predicting the future of mortgage rates is like predicting the future value of the stock market. Some one’s predictions will prove true but the problem is that we don’t who until after we arrived in the future.

Regardless, the current rate climate provides a tremendous opportunity for existing homeowners to take a look at their debts and see if a refinance wouldn’t make sense AND is helping to increase the affordability of housing across the country.

Believe it or not there are still many people who have yet to take advantage of these all-time low mortgage rates. Please contact me today if you would like a no obligation review of your personal situation. Furthermore, please mention this post to a co-worker, friend, or family member who you think would benefit. Thanks!

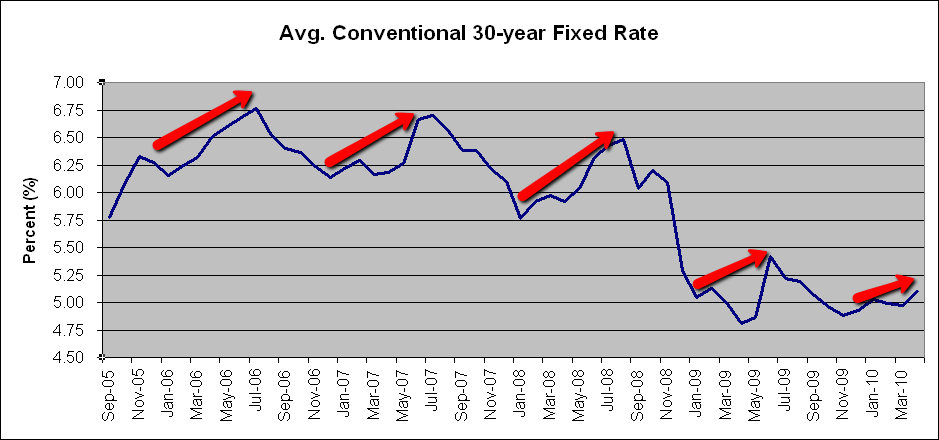

Be ready to lock in 2012

As mortgage rates hover near all-time lows many folks are curious if it makes sense to wait and see if rates will go even lower. If history is any indication it probably makes sense to lock in once we ring in the new year. From 2006-2010 mortgage rates were higher in June than they were the previous December in ever year except 2010 when the European Debt Crisis flared up again.

The European Debt Crisis does not seem to be going away any time soon and its existence has been the primary factor for rates achieving all-time lows so this year may be an anomaly but I still think a locking bias is a prudent approach as we enter the new year. Have a great holiday!

The European Debt Crisis does not seem to be going away any time soon and its existence has been the primary factor for rates achieving all-time lows so this year may be an anomaly but I still think a locking bias is a prudent approach as we enter the new year. Have a great holiday!

How BIG of a threat is inflation right now?

As I blogged about yesterday (HERE), the recent increase in mortgage rates has been prompted by an increase in inflation expectations. If you’ve been reading the newspaper or listening to some of the financial commentators then you may be worried about the recent increase to commodity prices. And if you monitor mortgage rates then you may be concerned because inflation is the primary driver of mortgage rates.

The Economist magazine have a couple good pieces about inflation in their current issue (see HERE and HERE). Their view? Inflation is certainly on the rise but mostly in the developing world where a greater percentage of income is spent on food and energy. In the developed world we are seeing price pressure but from very low levels and at this point it’s too early to sound any alarm on hyper-inflation.

In the developed world we are seeing price pressure but from very low levels and at this point it’s too early to sound any alarm on hyper-inflation.

This bodes well for interest rates. I’ve been writing since last fall that rates would have to begin moving higher. My hope is that they don’t get shocked higher but move gradually instead.

What do you think? Do you believe we’re in for an acute rise in rates or will they increase gradually? Leave your comments below.

How will developments in Egypt impact mortgage rates?

30 years ago when Egypt’s President Mubarak took power a mortgage applicant here in the US wouldn’t have paid any attention to geopolitical tension overseas for purposes of monitoring mortgage rates. However, in today’s global economy disruptions anywhere on the globe can have a ripple effect to other places. So how has political turmoil in Egypt impacted the markets here at home? Thus far, aside from Friday’s 166 point slide in the stock market we haven’t seen too much spillover. What do we need to watch for moving forward?

The WSJ’s MarketBeat blog is watching oil prices, gold prices, Israeli stocks, the US Dollar, and US Treasury prices as barometers. Mortgage rates are likely to follow suit with US Treasury prices. If violence and uncertainty surrounding the outcome of the protests continues to grow then we’d expect investors to seek “safe” investments which are typically fixed-income assets here in the US (including mortgage-backed bonds). This move known as a “flight-to-safety” would put downward pressure on rates. However, if the transition to a new regime is relatively smooth then we likely won’t see too much of a change.

Check back in to my daily mortgage rate updates for more information.

How inflation in China can impact mortgage rates at home

This morning it was announced that China raised its reserve requirement for the third time in a month. This monetary policy tool is designed to decrease the amount of money in circulation by restricting bank lending and ease inflationary pressure. Despite this action many analysts are concerned that inflationary pressure in China is too great and that they can expect to see price increases in the coming months. We should learn more tomorrow as China is scheduled to release their version of the consumer price index. And we may want to pay attention because inflation in China can put pressure on mortgage rates here at home. How?

If you are a regular reader of this blog then you know that inflation is the primary driver of interest rates. Simply put, if you lend someone some money today and you think the purchasing power of that money will be less in the future you will require a higher rate of interest to be paid for the right to borrow the money.

Chinese inflation can lead to inflation here in the US because we import so much from China. In fact, in 2009 the US imported almost $300 billion worth of goods and services. Therefore, if prices rise in China then the price of those goods that we purchase from them will rise as well. That is likely to impact the consumer price index here in the US and pressure mortgage rates higher.

Will mortgage rates benefit from another flight?

With much of the market’s attention being focused on the Fed’s QE2 announcement & last Friday’s monthly jobs report one storyline is flying under the radar. It’s been a few weeks since I’ve used the term “sovereign debt crisis” on this blog but it looks like it might be making a triumphant return. The WSJ ran THIS POST on the Marketbeat blog this morning entitled, “Euro-Zone Debt Problems Getting Worse“. In it the author points out that the yields on Irish and Portugal’s government debt have been rising as of late which means the fear of default are growing. Irish government 10-year bonds are currently trading with a yield of 9.24% and Portugal’s at 7.33%. To put this in perspective German 10-year bunds are currently selling at a yield of 2.41% and the US at 2.65%.

This could lead to another “flight-to-safety” in which investors of European bonds sell their positions and reinvest that money in US debt securities which are deemed to be less risky. If they do that would benefit mortgage rates.